Bank of America

BAC

BAC Fair Price

My Notes

Začít psátFeed

📊 US banks under pressure: Recession fears shake the market!📉

US bank stocks are losing ground, a direct result of growing fears of a possible recession. Investors are turning to safer assets, fleeing a sector that is closely linked to the state of the economy.

Citigroup $C, along with Wells Fargo $WFC, recorded the biggest loss over the past five days by more than 13 %, followe...

Read more

Zobrazit další komentáře

All I have from the US is $BAC. If one buys shares of those big banks, I don't think one has much to worry about. I would be much more afraid of the small ones.

Zobrazit další komentáře

🗓️Zajímavosti of the coming week!

Here is a summary of the interesting events that await us in the week ahead.

Monday: Fed Chairman Powell's speech 🗣️Jerome Powell will speak about the current state of the economy and USmonetary policy . His words may influence markets around the world.

Tuesday: US Retail Sales 🛒 The retail sales report will provide insight into consumer spending...

Read more

Zobrazit další komentáře

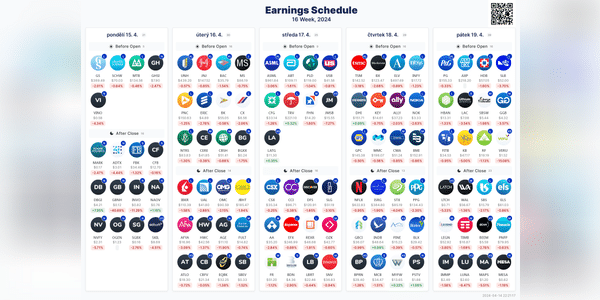

Netflixy is going to be a pushover. That's where I think it will be most interesting. Subscribers are what often diminish in the summer as people travel and don't watch movies.

Shares of $WFC fell more than 6% after the results. Currently, the bank's stock seems quite undervalued, and this drop creates an even more solid discount. I'm not buying since I already have $BAC in my portfolio , but this is a nice buying opportunity for me.

Hasanyone bought shares of $WFC?

🚀 This week will be very exciting in the markets!

The whole week will be accompanied by an unpleasant situation on the Middle Eastnamely the attack Iran on Israel and the possibility of further conflict. The White House wants to calm the situation to avoid escalation. This conflict could significantly affect the price of oil.

However, let us look at the key events that will bring...

Read more

📈💼 Interesting things in the banking sector!💡

Washington is caving in to pressure from big banks and rethinking capital buffer rules. Federal Reserve chairman Jerome Powell and Chairman FDIC's Martin Gruenberg expect major changes that could affect the banking sector and investors.

The new proposal would lead to 16% increase in capital levels and 20%

The proposal is under...

Read more

Zobrazit další komentáře

My favorites and in my portfolio are $BAC and $JPM. Otherwise, since I don't understand the banking sector that much (which is why I represent these two banks, where I think there's nothing to go wrong), I don't think I fully understand the change in the proposal, could you explain it for a moron? 😁 ...like is this supposed to be a change for the banks in the sense of how much capital they have to mandatorily hold just in case the economy struggles and in case more customers want to withdraw their accounts at the same time, so that they have something to draw on? ...

I didn't do any digging. If I had to guess, I'd say he sold it to collect a profit and get cash.

I still hold $BAC stock.