Părerea mea despre rezultatele Apple pentru ultimul trimestru! 🚀

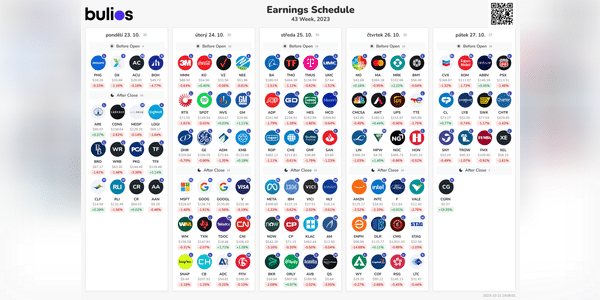

Creșterea solidă a cererii pentru noile iPhone-uri a compensat slăbiciunea treptată din alte segmente de activitate, confirmând durabilitatea acestui gigant tehnologic. Acest lucru este evidențiat și de veniturile obținute din vânzările de iPhone, care au atins 69,7 miliarde de dolarifață de o estimare 68,5...

Citește mai mult

Bulios Black

Acest utilizator are acces la conținut exclusiv, instrumente și caracteristici ale platformei Bulios datorită abonamentului său.

Super rezumat:) mulțumesc

Pentru mine rezultatele bine