Feed

L'industrie des médicaments contre l'obésité était en 2023 évaluée à 5,6 milliards de dollars et affichera un TCAC de 27 % entre 2024 et 2032 (avis d'expert).

$LLY, $NVO et d'autres créent des médicaments tels que - Ozempic, Wegovy, Mounjaro et Zepbound - Ce sont des blockbusters en termes de marché de la perte de poids à mon avis. Mais quelles sont les entreprises qui ont le...

Read more

📆 Aperçu des choses intéressantes pour la semaine à venir ! 🚀

Cette semaine, je regarderai surtout les résultats des entreprises. Avec le sentiment des investisseurs de la semaine dernière, je pense que des merveilles se produiront lorsque les marchés annonceront les résultats.

Lundi :

ISM Services PMI - Cet indice mesure l'activité économique dans le secteur des services et sert...

Read more

Les analystes de Berenberg ont relevé leurs estimations pour le marché mondial de l'obésité à 150 milliards de dollars d'ici 2035, contre 125 milliards de dollars précédemment. Cette révision est le résultat de données positives sur les comorbidités et d'avancées dans les études concurrentes. Berenberg recommande d'acheter des actions de $LLY et de Zealand Pharma, et de conser...

Read more

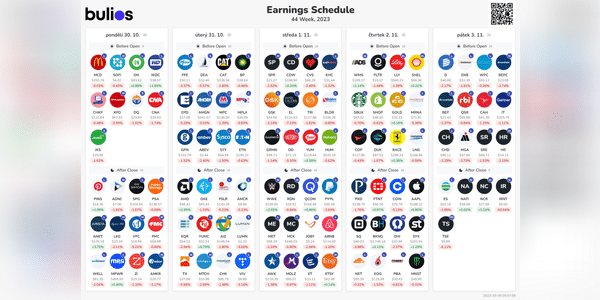

📊 Calendrier des investissements 📆

La saison des résultats bat son plein, et elle s'accompagne de nouvelles plus passionnantes les unes que les autres. Voici un résumé des nouvelles que je suivrai.

Lundi : Je ne regarderai que les résultats des entreprises.

📈 Bénéfices : Avant l'ouverture des marchés, je suivrai Domino's Pizza $DPZ, SoFi Technologies $SOFI et ON Semiconductor $ON...

Read more

📈💡 Nouvel acteur intéressant sur le marché pharmaceutique ! 💊🔍

L'un des sujets les plus discutés sur le marché pharmaceutique est le traitement de l'obésité et du diabète. Seules deux entreprises sont à l'origine de nombreux médicaments à succès tels qu'Ozempic, Rybelsus et Saxenda: Novo Nordisk $NVO et Eli Lilly $LLY. Ces sociétés ont connu un succès important dans le...

Read more

ELI LILLY POURRAIT CHANGER LA DONNE DANS LE SECTEUR DES SOINS DE SANTÉ

-Eli Lilly $LLY est actuellement l'entreprise de soins de santé la plus précieuse au monde, évaluée à environ 550 milliards de dollars.

- L'action de l'entreprise a été l'une des les plus recherchées dans le secteur de la santé.

- Malgré cette valeur élevée, il existe de nombreuses opportunités de croissance po...

Read more

Aujourd'hui, j'ai regardé de plus près $LLY, que j'aime beaucoup et j'aimerais inclure des actions de cette société dans mon portefeuille, mais l'action est très chère en ce moment et j'achèterais personnellement jusqu'à moins de 450 $.

Comment voyez-vous cette société et avez-vous des actions de cette société dans votre portefeuille ?

Le secteur de la santé est l'un des secteurs les plus populaires auprès des investisseurs, en particulier les investisseurs de type "value". Que penser, la santé est la chose que nous devrions protéger le plus dans notre vie, et les entreprises qui sont impliquées dans ce secteur en profiteront peut-être indéfiniment. Grâce à elles, notre société peut vivre jusqu'à un âge...

Read more

La société pharmaceutique américaine Eli Lilly and Company a publié ses résultats aujourd'hui, qui ont dépassé les attentes et les actions de $LLY ont augmenté de plus de 15% en réaction. Les fondamentaux sont assez solides et l'action est en hausse de plus de 40% sur l'année, ce que j'apprécie et comme je vois un potentiel dans les soins de santé et que j'aime les sociétés...

Read more