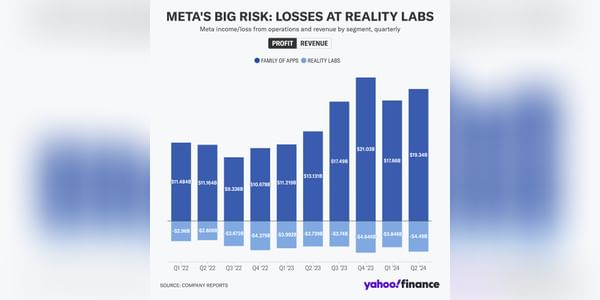

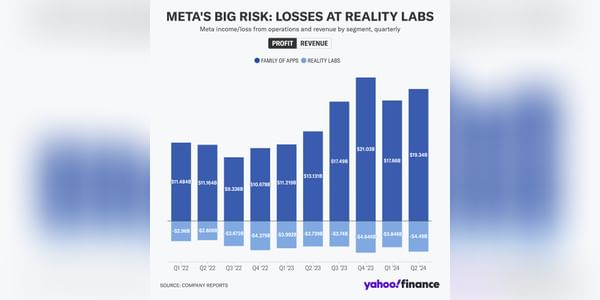

Wyniki $META są świetne, ale co z segmentem Reality Labs? Czy można mu zaufać? Na razie to tylko spalarnia pieniędzy. Do końca 2020 r. jednostka Reality Labs wygenerowała skumulowane straty w wysokości około 50 miliardów dolarów!

Wyniki $META są świetne, ale co z segmentem Reality Labs? Czy można mu zaufać? Na razie to tylko spalarnia pieniędzy. Do końca 2020 r. jednostka Reality Labs wygenerowała skumulowane straty w wysokości około 50 miliardów dolarów!

Mark Zuckerberg powiedział, że kwartał $META był sukcesem, a Meta AI ma potencjał, aby stać się najczęściej używanym asystentem AI na świecie do końca roku. To dość odważne słowa. Jak myślisz, kto jest obecnie liderem pod względem sztucznej inteligencji i asystentów AI?

Ten użytkownik ma dostęp do ekskluzywnych treści, narzędzi i funkcji platformy Bulios dzięki swojej subskrypcji.

Trudno powiedzieć, wszystko jest jeszcze stosunkowo wcześnie, więc nie chcę oceniać. Myślę, że wciąż jest dość równo i czas pokaże, kto śpi, a kto prowadzi.

Ten użytkownik ma dostęp do ekskluzywnych treści, narzędzi i funkcji platformy Bulios dzięki swojej subskrypcji.

🗓️Přehled wydarzeń tego tygodnia, których nie można przegapić!

Hej inwestorzy, oto kolejny przegląd najważniejszych wydarzeń nadchodzącego tygodnia. Moim zdaniem ten tydzień będzie jednym z najciekawszych pod względem wyników finansowych.

Poniedziałek: Zyski: Przed otwarciem rynków ONSemi $ON, firma zajmująca się półprzewodnikami , która obecnie współpracuje zVolkswagenem ,...

Czytaj więcej

Ten użytkownik ma dostęp do ekskluzywnych treści, narzędzi i funkcji platformy Bulios dzięki swojej subskrypcji.

Dzięki za przegląd. Jest tam wiele wyników i ogólnie będzie to pracowity tydzień. Obecnie jestem na wakacjach, ale postaram się przynajmniej trochę nadążyć😁.

Ten użytkownik ma dostęp do ekskluzywnych treści, narzędzi i funkcji platformy Bulios dzięki swojej subskrypcji.

Wczoraj amerykański rynek akcji zanotował niezły wzrost, a wiele akcji osiągnęło swoje historyczne maksima. Na przykład,$GOOG, $AAPL, $MSFT, $NFLX i $META osiągnęłyswoje ATH . Obecnie nie kupuję zbyt wiele w okresie letnim i raczej się wstrzymuję, ale nadal korzystam z DCA na $CSPX.L.

Jak obecnie podchodzisz do akcji? Kupujesz, trzymasz czy sprzedajesz?

Na razie jest to raczej strategia "trzymaj lub sprzedaj". Do kupna dojdzie, ale wtedy, gdy na wykresie będzie znacznie więcej czerwonego.

Ten użytkownik ma dostęp do ekskluzywnych treści, narzędzi i funkcji platformy Bulios dzięki swojej subskrypcji.

⚠️ Nieoczekiwane zwroty akcji na rynkach! 🚨

W tym tygodniu jesteśmy świadkami niesamowitego spektaklu!

Meta $META były Facebook ogłosił wyniki powyżej oczekiwań analityków, ale podał gorsze prognozy. Akcje spółki zareagowały na to dziś spadkiem o ponad 10 %. Z drugiej strony jest Tesla $TSLA, która została pobita w wynikach, ale cena akcji wzrosła o ponad 17 %. Jak to mówią,...

Czytaj więcej

Jeśli chodzi o PKB, oto komentarz, który oddaje dylemat, przed którym stanął Fed

"Fed znalazł się teraz między młotem a kowadłem. Dane dotyczące wzrostu gospodarczego sugerują, że polityka pieniężna zadziałała magicznie i można nieco poluzować hamulec monetarny Fed. Dane dotyczące inflacji sugerują jednak co innego" - powiedział Stuart Cole, główny ekonomista ds. makroekonomicznych w Equiti Capital w Londynie.

To po prostu zakład na przyszłość. Jeśli to zadziała, szybko wróci, ale na razie akcjonariusze będą musieli to znieść.