This internet company has lost 72% of its value, but analysts are buying it in bulk

There are a number of companies that sell everything you can think of on the internet, led by Amazon $AMZN-1.3%, but when it comes to goods that are at least 20 years old or handmade, Etsy $ETSY-0.7% is the top seller.

After growth stocks succumbed to the strength of last year's bear market, they've been bouncing since the start of 2023.

Not all growth stocks are joining the rising growth club, however. E-commerce specialist Etsy $ETSY-0.7% is one of those stocks that has fallen so far this year. The company's share price is down 25% since the beginning of the year.

The company is undoubtedly facing some issues that are hard to ignore. Still, analysts are not going to miss this opportunity. They are buying Etsy stock especially at current levels, where they find this company ridiculously cheap.

Etsy, Inc.

ETSYIn the first quarter, Etsy's revenue increased 10.6% year-over-year to $640.9 million. That's a much slower revenue growth rate than the company's historical model - but at least the top line is moving in the right direction.

The company's net income fell to $74.5 million, down 13.4% year-over-year. Still, given the challenging economic environment over the past year, it's not surprising to see an overall decline. After all, the same has happened to many other e-commerce specialists. On closer examination, however, the problem is more with revenue growth.

Last year, the company increased the seller transaction fee from 5% to 6.5%. The change took effect on April 11, 2022. Given that the company's merchandise sales declined last quarter, the top line would have fallen if not for the increased transaction fee the company slapped on sellers starting in the second quarter of last year.

We can expect $ETSY'-0.7% s revenue to move downward, at least for a while. The company's platform focuses on vintage and handmade goods that aren't known for being cheap.

Consumers will likely reduce spending on the types of goods on the Etsy platform in the event of an economic downturn. As a result of these factors, investors are selling off shares of the company.

The company's advantages

1. Etsy has great quality and speed in delivering individual orders. For example, if you order an item from Europe to the US, you will receive it within 3 days of ordering even for a relatively small order - (under $100 including shipping).

2. The market for handmade or vintage (older) items - is still without much competition. The company estimates the total value of this market at $2 trillion, of which it has captured only a tiny fraction. This leaves plenty of gaps in Etsy's specialization.

3. The company has built a competitive advantage, namely the inertia effect. The more buyers on its platform, the more attractive it becomes to sellers looking specifically for older and handmade goods, so the value of its website increases as more people use it.

The company's sales have increased significantly in the covid years as everyone has started to shop online. It's not the only company still recovering from those years. Despite the fact that the pandemic years didn't hurt the company from the inside, it is now struggling like many others with falling profits. That's logical when normal stores are open and customers don't have to shop exclusively online.

The market in which Etsy operates is still very attractive and doesn't have as much competition as, say, Amazon's $AMZN-1.3%. Specialty online stores have bright times ahead of seboi, and $ETSY-0.7% will be no exception.

The stock offers a nice return at today's prices, which are around the $85 level. If the price hits the highs of recent years, an investor will make over 250% on today's prices and that's a decent return.

Analysts are predicting significant growth in the tens of %. The overwhelming majority agreed to buy, and of the 31 analysts who didn't want to buy, 13 sided with HOLD. Only 2 have decided to sell Etsy.

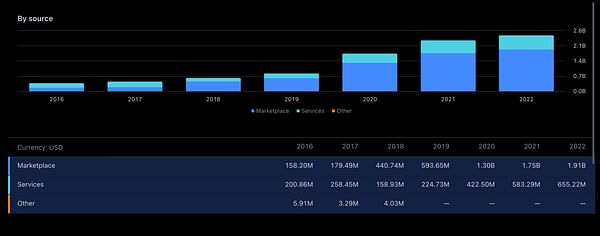

The company is no longer relying solely on its store, which accounts for 75% of the company's revenue, most of which comes from the United States, but is also starting to build up its services line item. These currently generate 25% of its earnings, giving Etsy an excellent diversification of its business.

Do you have $ETSY-0.7% in your portfolio or is this company not a good fit?

It is not a financial advisory business. I am providing publicly available data and sharing my opinions on how I would handle myself in these situations. Investing is risky and everyone is responsible for their decisions.