2 stocks under $70 that you can buy and never sell

Sometimes you want to have a stable component in your portfolio that will hold you up even in the worst of times. If it has been paying a dividend for a few decades on top of that, it's a great choice for those who want to diversify, don't want to take unnecessary risk, and aren't targeting 50% growth every year.

1. The Coca-Cola Company ($KO)

Warren Buffett' s favorite stock needs little introduction. It is one of the largest companies that not only produces the world-famous Coca-Cola drink, but also owns brands like Fanta, Sprite, Nestea and Cappy.

It has been in Buffett's portfolio for several decades and has made him rich in that time. Berkshire owns a stake worth $24 billion, the third-largest stake Buffett has in the portfolio.

Today's world helps Coca-Cola with an ever-growing customer base. Their products are truly everywhere , from restaurants to vending machines to food stands. Recently, the company has had to raise the prices of their products due to inflation, but they have not encountered a drop in demand.

This shows not only the incredible strength of the brand, but also that people have become accustomed to these products over the years and take them as their daily bread. Buffett himself is known to have a Coke every morning.

Today, the company is one of the biggest in the world. With annual sales of $43 billion, the behemoth has recently seen its share price hit new highs.

The company doesn't bottle most of its products; instead, it sells concentrates to bottlers, making Coca-Cola a business that doesn't need much money to operate. This allows it to return a large part of its annual profits to shareholders. The company has paid andincreased its dividend for 61 consecutive years.

Analysts put the forward price at $70, up +17% from today's prices.

Today, the stock is trading at about $60 apiece, giving investors a 3% dividend yield. Analysts believe the company will earn $2.61 per share in 2023 and grow earnings at an average of 7% per year over the next three to five years. That's a price-to-earnings (P/E) ratio of 23. That's a small premium for such a great company.

2. Enbridge ($ENB)

Enbridge is one of the largest energy companies in North America. It operates in the transportation, distribution, and generation of energy, mostly in the form of crude oil, liquefied natural gas, and renewable energy. It provides infrastructure for its clients to transport their products.

The company operates an extensive network of pipelines that transport crude oil, natural gas liquids and natural gas liquids across Canada and the United States. The company also has interests in renewable energy such as solar, wind and bioenergy.

Its natural gas pipelines transport about 20% of all gas in the Americas. Enbridge also owns Enbridge Gas, the largest gas company by volume in North America. The company has a growing base of renewable energy sources, including solar, wind, geothermal and wastewater treatment. Overall, Enbridge generates more than $38 billion in annual revenue.

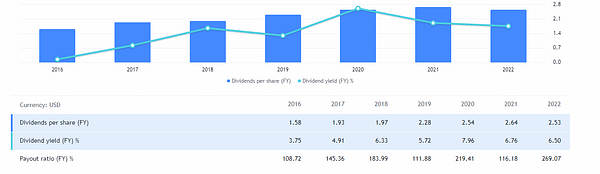

The company has paid and increased its dividend for 27 consecutive years. The dividend yield is 7.35% at today's share price ($35.61). While the energy industry can be sensitive to economic fluctuations, a company like Enbridge is more like a toll road for energy resources. It's not as sensitive to prices in commodity markets, which has helped Enbridge continue to grow its payout over the past three decades despite occasional price swings.

Management is investing $17 billion between 2023 and 2025 in projects that strengthen all aspects of their business, including renewable energy. As a result, management believes Enbridge could grow 5% per year in terms of earnings after 2025.

Each of these companies is interesting in its own way and it's not a bad idea to take a closer look at them. I have $KO in my portfolio and can't get enough of it. I'm sure there are plenty of investors among you who own Coca-Cola stock. It's such a well-known classic, but I'm more curious if you knew about $ENB and if anyone has it in their portfolio. The dividend yield is also very appealing and looking at the chart, you can see a nice stability. Don't expect any big fluctuations here like on small tech companies. This is a little different coffee.

This is not financial advice. I am providing publicly available data and sharing my opinions on how I would handle myself in given situations. Investing is risky and everyone is responsible for their decisions.

I really like$KO. Both the stock and the products. It's one of my favorite stocks outside of tech companies. :)

I know them both, both are great, $KO classic, I've had it for over six months, but as you say, it's a stability that doesn't move much, so I've put the funds from it elsewhere. The $ENB I was considering and I don't even know why I walked away from it, now I see it's at last October's prices, so I'm thinking a lot about buying it now because the stable looks like it is and it has a nice dividend. 👍