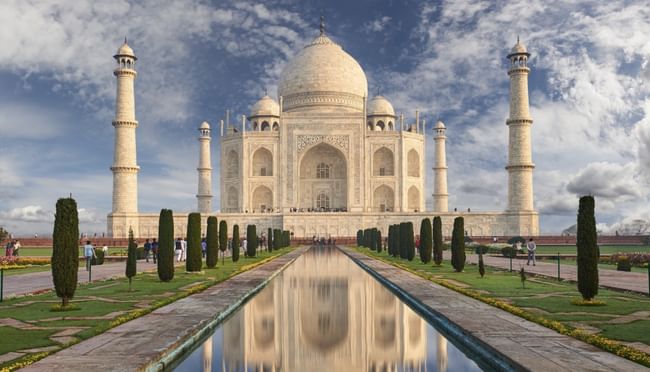

Let's take a step away from the US to the Indus.

JP Morgan raises India's economic outlook for 2024.

The investment bank has raised its growth forecast for 2024 to 5.5% from 5%. The revision follows the latest gross domestic product data this week, which showed that India's economy accelerated by 6.1% in January-March, up from 4.5% in the previous quarter.

The economy has started the year "very strongly because growth came much faster than what the market consensus was," said DBS Bank chief economist Radhika Rao.

"We note the continued strength in India's services exports and how exports of goods have cyclically performed better than expected," JPMorgan said in a note.

There were also "several positive surprises, including manufacturing, construction and agricultural output... fixed investment growth also performed better," Rao told CNBC's "Street Signs Asia" on Thursday.

But at the same time, JPMorgan remains cautious about the country's growth prospects next year. Although the government has announced an increase in capital spending, it will take time for that to translate into a broader cycle of private investment. "Over the last six months we have seen a noticeable decline in foreign direct investment around the world," Aziz said, adding that it has also fallen in India and China. The investment bank also expects exports from India to fall as global growth slows with more advanced economies heading towards recession.

So how do you see it my friends? ...About a month ago, we were discussing the market here and the prevailing view was that you see this as an interesting opportunity. Has the attitude changed or have you found and included any particular company in that market in your portfolio? 😊

Does anyone have a favourite Indian stock? :)

So far, the only exposure (and it's not a small one) I have to the Indian market is within $BTI. It has ≈1/3 of the Indian conglomerate ITC, which has been growing for a long time and I expect it to continue. I continue to increase my position in $BTI. Otherwise, my attitude is still the same - I would like to get involved in investing somehow in the form of some Indian ETFs, but I guess I'm too lazy/conservative to do so.