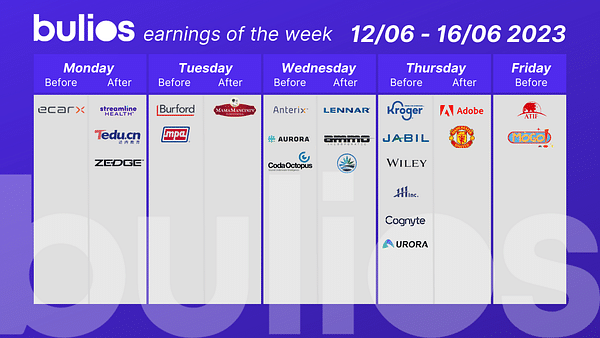

Quarterly results of companies in the week 12.06. - 16.06: Adobe, Kroger, Jabil

Looking at the results season, it's again a severe weakness. And to make matters worse, the results of the more interesting companies are not due for another two weeks. So for this week we have to settle for results from Adobe $ADBE, Kroger $KR and Jabil $JBL among the more interesting companies.

What do analysts expect from these companies?

Adobe $ADBE

For the fiscal first quarter, the company expects non-GAAP earnings in the $3.65 to $3.70 per share range. The Zacks Consensus Estimate for earnings is set at $3.66 per share, which implies an 8.6% growth from a year ago.

Adobe estimates total revenue between $4.60 billion and $4.64 billion. The consensus value for the same is pegged at $4.61 billion, implying a growth of 8.3% over the previous year.

The robust Creative Cloud and Document Cloud services are expected to have contributed well to the performance of the digital media segment in the fiscal first quarter. Adobe expects digital media revenue between $3.350 billion and $3.375 billion.

Growing adoption of Premiere Pro, solid momentum across the Adobe Express platform and benefits from the acquisition of Frame.io in the year under review are expected to accelerate Creative's revenue growth in the quarter.

Kroger $KR

Kroger is expected to report earnings of $1.41 per share for the current quarter, a year-over-year change of -2.8%.

In Kroger's case, the consensus revenue estimate is $45.38 billion for the current quarter, indicating a year-over-year change of +1.7%. Estimates of $152.03 billion and $151.89 billion for the current and next fiscal year, respectively, indicate changes of +2.5% and -0.1%.

Jabil $JBL

This electronics manufacturer is expected to post quarterly earnings of $1.88 per share in its upcoming report, representing a year-over-year change of +9.3%.

Revenue is expected to be $8.16 billion, down 2% from the previous quarter.

Aurora $ACB

The current consensus EPS estimate is $-0.06 on revenue of $48.38 million for the upcoming quarter and $-0.34 on revenue of $176.58 million for the current fiscal year. All of the above numbers are expected to be down quarter-over-quarter and year-over-year.

Manchester United $MANU

The current consensus EPS estimate is $-0.11 on revenue of $178.12 million for the upcoming quarter and $-0.36 on revenue of $734 million for the current fiscal year. Here, it will also be a quarterly decline in both cases.

- Whose results do you care about? Let me know in the comments!

It's true that there aren't many interesting companies out there anymore. However, $ADBE will definitely interest me.

For me I also have nothing in my portfolio but $ADBE and on Monday should be $ORCL It Adobe has also been flying a lot lately, so I wonder how far it can go.😁

Probably nothing interesting to me. I'm just surprised that Manchester United is publicly traded.

It may be empty, but Adobe will certainly be interesting. I'll keep an eye on it. I remember trading $KR once with options sometime last year and the trade was kind of mushy non-salty. There was a breakout to a new high, I grabbed that. Right now the price isn't doing anything wild and is holding pretty high.

Oh yeah, tech companies now have to show if they can sustain growth despite the economic downturn. It will be interesting to watch. Adobe and Jabil could surprise, Kroger probably not so much. We'll see how the numbers turn out.

I'm mainly interested in Adobe's results. How they managed to cope with the negative effects of the pandemic and how they managed to grow in the cloud. This will show how resilient the technology sector could be.