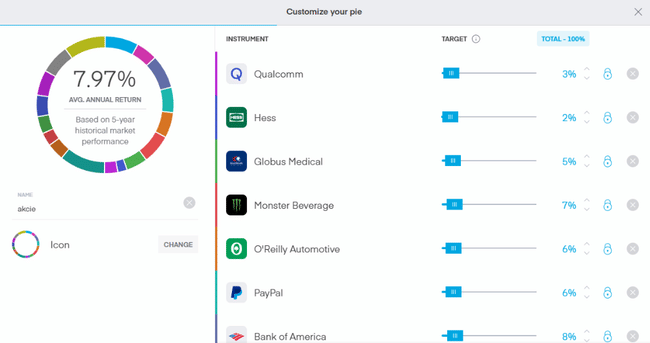

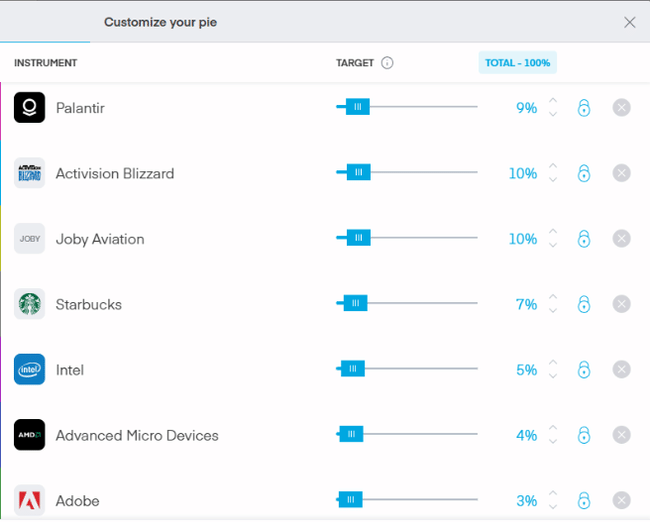

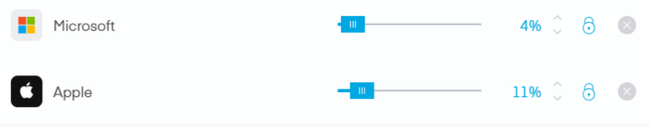

Okay guys, I'm going to go to the market with my skin on and I want to hear your opinions. This is what my portfolio looks like after last week's edits. I'd love to hear what you have to say about selection, composition, riskiness, diversification, what you wouldn't buy for example, and conversely, what you would change or add for example?

I'm still thinking about what to do with the Palantir. I've already got it pretty much in the black, so maybe I'll sell a little bit there gradually.

Except for $PYPL, we disagree on nothing. To me there is a lack of greater diversification across sectors, but the potential is great because of it. I might still ask myself if you manage to actively follow all these companies and understand them all, but 16 titles might be fine. If I were you I would probably gradually sell off the more profitable titles that are at high levels (Apple, AMD,...), which I don't advise of course. I did that myself and my portfolio is now more defensive.

Fingers crossed!

If I had such a portfolio, I'd take the Nasdaq 100 straight out, which would give me huge advantages with ETFs. Add to that some banks and stuff and I'm happy. 👌

I was looking and there was just a recent Academy article about the Nasdaq:

https://bulios.com/academy/post/59-index-nasdaq-100-pruvodce-technologickym-a-inovativnim-sektorem

So I have nothing against this formula either. There are some really quality stocks out there and the diversification between companies works across several sectors as well. This is a future-ready portfolio.

Great, nice work! 😊 There are companies I don't know like the globus medical one and I also looked at it like Tomas below. I have some healthy stocks but they don't really work for me yet. Here though I like the product they make. Otherwise, I guess I'll also join that mainly technology portfolio and yes, hence it can be more volatile but like you say, you want growth stocks and you can weather any downturn so why not. Personally I also have the most in big tech like Microsoft, Google, Apple, Amazon, even in Mete which not many people need but makes me a profit. 😊 So for me inspiration from you Globus Medical. Then I like that you included Starbucks, I wrote about it here a while ago and I was waiting for it to drop below $100, it might be a good buy. Then if you got a good Adobe purchase, congrats on that too. And otherwise I'm with you on the portfolio, Apple, Microsoft, Starbucks, Blizzard, Bank of America, PayPal. So for me 👍 I'm going similarly, but admittedly I also have stable stocks whether in the Reit sector or (and I don't know what to call this), $PG $COST stocks ...

I like your bold approach! This is a portfolio that has a chance to appreciate significantly in the coming years if you have good shopping. Of course it's riskier, but you can't make big money without courage and betting on the future. Those who take no risks make no profits. Fingers crossed that your bold strategy pays off 💪.

Too risky for my taste. Only a small percentage of reliable and proven companies. The rest are more like bets. I would recommend cutting the number of titles about in half, weeding out the riskiest ones and buying more conservative ETFs, bonds or dividend payers. The spread could be something like 70-80% reliable investments and 20-30% bets. It's purely your choice, if this composition works for you and you're in profit, then you're doing your job well.

The portfolio looks quite interesting. Solid selection of growth and value stocks. I'm glad to see older and larger companies like Intel or MSFT. The only one I would consider eliminating is Bank of America - too much political controversy for results. And holdings like Berkshire are more to my liking. Plus you have a lot of growth tech stocks, I would welcome more defensive titles for stability. And maybe pieces like Joby and Palantir I wouldn't hold. I was surprised by Globus Medical though, I don't even know that company.