Airbnb has become synonymous with travel and accommodation in the 21st century. This innovative platform allows people from all over the world to rent out their apartments, houses or rooms to other travellers. What started as a humble idea has evolved into one of the largest and most influential companies in the accommodation industry.

This platform has brought a whole new way to travel and explore the world. Booking accommodation through Airbnb allows people to experience authentic local life and tap into areas that might remain hidden during traditional hotel stays. With Airbnb, travel becomes more personalized and unique.

Due to Airbnb's growing popularity and scale, the company has decided to go public and offer its shares to investors. This move marks a significant milestone in Airbnb's history and signals its ambition to expand and strengthen its market position. Investing in Airbnb shares can provide an opportunity for both individual investors and institutional players.

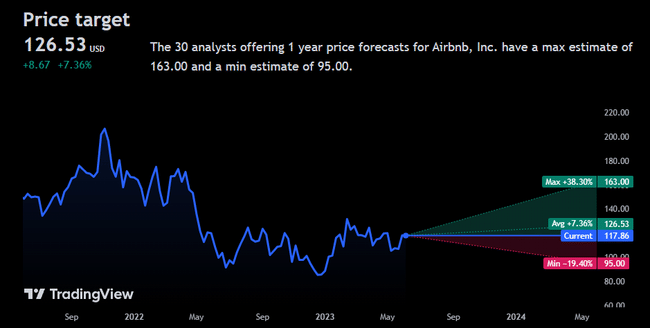

Airbnb $ABNB shareholders are having a great year. The stock has not lagged the S&P 500 index at all, and has returned over 30% for the year. Airbnb's latest quarterly update helped extend those gains, even as management predicted slower revenue growth trends in the second fiscal quarter.

1. Healthy growth

Investors were concerned that Airbnb would begin to see increased sales pressures from competitors, rising prices, and a slowing economic growth trend. However, these factors did not change the stock's impressive momentum even at the start of 2023.

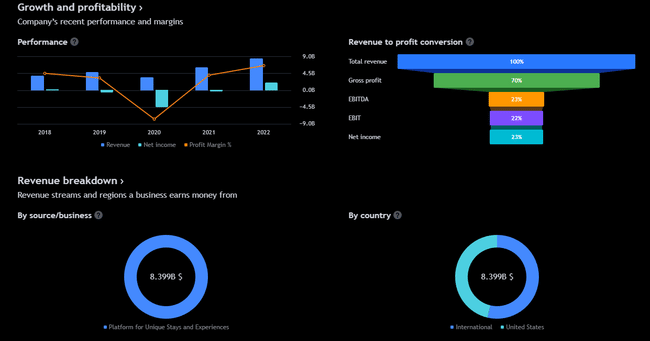

Airbnb saw a 19% increase in bookings in the first quarter, up to 121 million, along with a 25% increase in backlog. Its global footprint has been a valuable asset here. While sales in the U.S. grew 13%, sales grew faster in countries such as Latin America, Asia and Europe. As a result, average daily rates held steady at $168.

2. Extensive cash flow

Investors focused on Airbnb's improving profitability, with net income in positive territory for the fifth consecutive quarter. The company reported its first-ever year of positive earnings in 2022 and is looking to improve margins this year.

But much more investor enthusiasm flows from cash flow, which already points to excellent financial strength ahead. Airbnb now consistently converts more than 40% of revenue into free cash flow on an annual basis. That number reached a record $3.8 billion in the first quarter after quarterly free cash flow jumped 87%.

Increasing investor returns can be achieved in several ways, including increasing returns over time. Plenty of cash also drives aggressive spending on share buybacks, which reduced the number of shares outstanding to 697 million in the first quarter from 706 million a year earlier.

3. Emphasis on strengthening long-term supply

Travelers, especially in the U.S., are becoming more cautious about booking more expensive rooms and homes. Airbnb hopes to counteract this problem with price changes that will give hosts incentives to be more competitive in this area . Investors here will want to track average daily rates to see how the area and the company as a whole is doing.

Airbnb's supply of homes is also a key metric to monitor going forward. It's important that supply grows at least in pace with demand in the company's urban and non-urban markets. That's why the company is working to make hosting easier and pushing into new spaces like apartments. "Airbnb travel is mainstream," executives said in a letter to shareholders. "We want hosting to be just as popular."

I don't have personal experience with Airbnb yet, but from my knowledge of my surroundings, it's a really brilliant business model. All 3 parties (the property owner, Airbnb and the traveler) make a profit. It's already a giant competitor to hotels, which will probably find it increasingly difficult if only because they have much more expenses for management and maintenance. Does anyone have experience with Airbnb?

This is not financial advice. I'm providing publicly available data and sharing my views on how I would handle the situation myself. Investing is risky and everyone is responsible for their decisions.

The stock is really flying up now, I didn't trust it much either and missed the opportunity to buy below $100, then I bought a bit at $111, now the price is $123, let's see how far it goes, I feel like buying more.

Not buying ABNB on the low was one of my biggest mistakes. I considered it at $90, but in the end I didn't trust them that much. And what happens? ABNB skyrocketed to $140, currently 117 as of today 😄.