If you've got $500, you should have your eye on these oil companies

Given the inherent volatility of the energy sector, most investors would be better off not trying to time the ups and downs of energy prices. A much better option is to recognize that you can't and it is easier to have continued exposure to the sector through all periods. Then the investor can focus on individual stocks in that sector and drop the ETFs a bit. This will lead directly to great companies like Exxon, Chevron and TotalEnergies.

These companies cover the entire energy sector, from drilling for power to power to refining to chemicals. Although commodity prices play a significant role in earnings, the inherent diversification across the energy sector provides some balance that helps mitigate the ups and downs.

Moreover, diversification makes these companies something of a one-stop shop for energy exposure. This simplifies the investment process because you don't need to add a drilling, refining and pipeline company.

While more stocks can increase diversification, you should avoid making so many investments that you can't keep track of them. One good integrated energy stock will help keep your portfolio stable. Less is sometimes more so you need to "tame" yourself even in this very tempting sector.

1. ExxonMobil $XOM-1.9%

ExxonMobil is the largest of this trio with a massive market capitalization of $425 billion. The company shares profits with shareholders, which are 3.5%.

The dividend has been increased every year for 41 consecutive years. Not too long ago, the company lagged behind its peers in production, but it has invested heavily to change that. Today, the company's production is strong and it has been able to reduce production costs and improve profitability. Simply put, this giant is back in the game.

Exxon Mobil

XOMThe company's balance sheet is among the strongest in the industry with a debt-to-equity ratio of just 0.2. Historically, this financial strength has allowed Exxon to take on debt during industry downturns so it can continue to invest in its business and pay a growing dividend.

It is currently trading very close to its all-time highs, which it reached in relatively recent times. The whole sector is really interesting right now and if anyone is thinking about this company, they are on the right track.

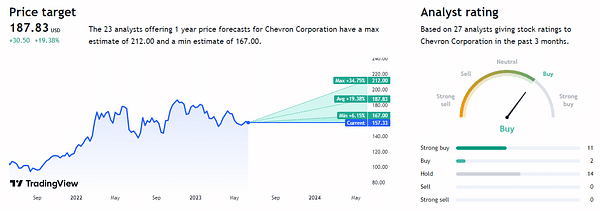

2. Chevron $CVX-1.0%

Chevron has a market value of $295 billion. Its dividend yield is roughly 4%. And the payout has increased every year for 36 years. Like Exxon, Chevron has a solid balance sheet with an even lower debt-to-equity ratio: 0.15 times. From a business perspective, Chevron performs as well as Exxon on most comparative points.

Exxon Mobil

XOMFor long-term investors, then, the real question is which of these rivals to choose. Conservative investors who want to maximize the income they generate are more likely to want a higher yield and an even stronger balance sheet. In that case, they will probably end up better off with Chevron.

The chart for these companies is not much different either. Both have risen over 150% since the covide lows and are now hovering around peak prices. Given the strength of these companies and current and future global demand for their services, this is a good portfolio component and a solid representation of the energy sector.

Exxon's larger scale provides some advantages such as access to capital and the ability to take on larger projects. Every company has something going for it. Both would be solid choices, although the best option might be to buy both.

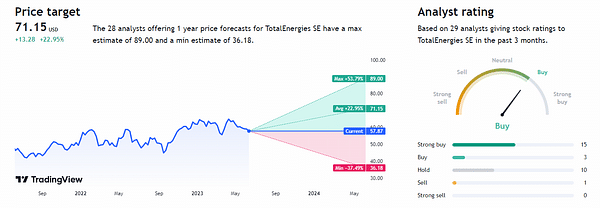

3. TotalEnergies $TTE-1.1%

TotalEnergies, with a market cap of $140 billion, doesn't have such an impressive track record when it comes to dividends. In fact, its most impressive dividend stat today is that it didn't cut its dividend in 2020 when industry competitors like $BP-1.4% Shell $SHEL-1.0% did.

Those dividend cuts came as BP and Shell announced they would invest more in clean energy. TotalEnergies made the same investment shift, but it was very clear that the dividend was important to the company because it knew how important it was to investors.

TotalEnergies SE

TTEFrom this perspective alone, it is clear that companies care about their investors and that is always good for their shareholders. If a company cares about its investors and produces steady profits for them, everyone is happy and can expect more money to flow in.

In the oil sector, this company creates an opportunity for investors who realise that clean energy will become increasingly important. You could try to pick a winner in the clean energy sector, but it is very early days yet.

Allowing a financially strong company like TotalEnergies to handle the changing currents in the sector is probably a safer alternative for most investors. Add in a nearly 5% dividend yield and the stock becomes a little more interesting again.

This entire sector offers a really big opportunity for all investors going forward. Oil itself has been very volatile in the stock market, although it has barely budged in the last 6 months. The future is in energy and even more so in clean energy. If these companies can achieve the desired result in renewability, it will be better for humanity and investors.

This is not financial advice. I am providing publicly available data and sharing my views on how I myself would act in these situations. Investing is risky and everyone is responsible for their decisions.