Are these the best dividend paying companies that will be paying a dividend for decades to come?

Dividend companies interest us all here. We deal with history, stability, numbers... but we're all interested in one thing in particular that we're kind of afraid to discuss out loud - the future.

We all know that none of us has a crystal ball and can predict future results and developments with certainty. Everyone has to make these estimates for themselves. Anyway, I can at least give you a tip on companies that could at least potentially continue to deliver their handsome dividend.

Microsoft $MSFT-0.2%

Tech giant Microsoft earns steady profit streams from its software and cloud business. The company started paying dividends in 2003, and its dividend has grown every year since. The yield is just under 1%, which isn't much, but then again, it's nicely sustainable. Strong cash generation, healthy debt levels, and brisk M&A activity give Microsoft plenty of room to continue to increase its dividend.

Microsoft

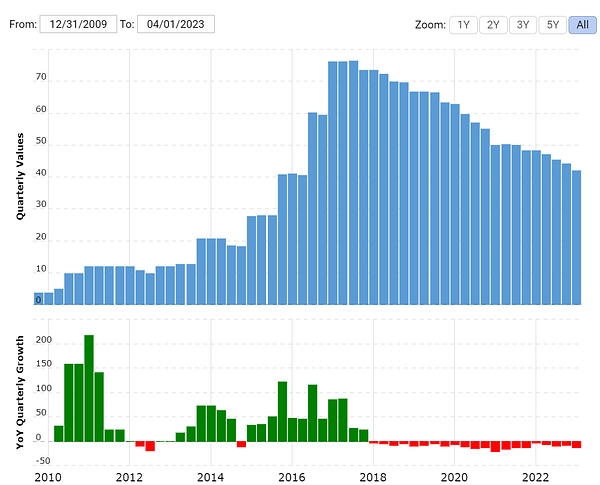

MSFTMicrosoft began paying dividends to its shareholders in 2003. Since then, the company has increased the amount of dividends paid each year. For example, in the last quarter of last year, Microsoft paid out a total of $4.6 billion in dividends. In total, Microsoft has returned over $140 billion to shareholders in dividends over the past 10 years, a return of nearly 150%. The dividend has grown at a rate of around 10% each year.

The current dividend yield is less than 1%. But given the growth in sales, earnings and free cash flow, analysts see room for further dividend increases. Microsoft's strong earnings from software and cloud services sales, its low debt and brisk acquisition activity give the company plenty of cash to increase dividend payments in the future.

Management states that they intend to maintain and increase dividends at a level consistent with their long-term outlook for revenue, operating profit and free cash flow.

So in summary, Microsoft has a stable and relatively young dividend policy that focuses on long-term sustainable dividend growth in line with the company's cash flow growth. The profits generated from the core business and the asset of cash on the balance sheet give Microsoft theoretically enough room to continue to increase dividend payments in the future.

Johnson & Johnson $JNJ+0.2%

This healthcare company with a 114-year history is a long-term dividend payer. JNJ has a steady source of revenue from its devices, medical products and pharmaceuticals. The dividend has been paid for 60 years without interruption and has grown every year since 2004. With a strong brand, a diversified product portfolio and low debt, JNJ has sufficient funds to continue to increase its dividend.

Johnson & Johnson began paying dividends in 1944 and this year celebrates its 60th anniversary of continually increasing dividend payments. This makes it one of the companies with the longest history of continuous dividend increases.

The dividend yield is currently around 2.8%, with the company increasing the dividend by an average of 6% each year. Over the past 10 years, the dividend has increased by a total of 59%.

Johnson & Johnson generates steady profits from the sale of its pharmaceutical, medical and consumer products. As a result, it has sufficient resources to pay dividends and dividend increases. The company has a strong balance sheet with a low debt ratio, which allows it to invest in business growth and continue to pay dividends to shareholders.

Management is understandably as supportive as possible of dividend payments. In summary, Johnson & Johnson is one of the companies with the longest history of dividend growth. Stable net income, a strong balance sheet, and a strategic focus on dividend growth give this century-old company plenty of room to continue increasing its dividend over the longer term. And investors clearly believe strongly in it.

Disclaimer: This is by no means an investment recommendation. This is purely my summary and analysis based on data from the internet and other sources. Investing in the financial markets is risky and everyone should invest based on their own decisions. I am just an amateur sharing my opinions.