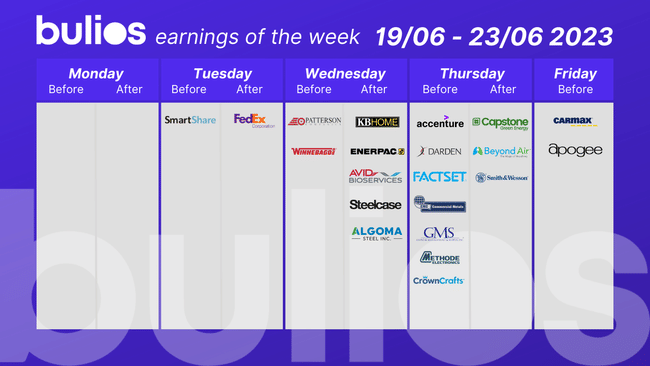

Earnings season will not offer us many interesting companies for the second week in a row. However, as we approach the end of the month, I can assure you that the results season will get going again.

What do analysts expect from these companies?

FedEx $FDX

The Zacks Consensus Estimate for segment sales suggests a decline of 9.5% from the previous fiscal quarter.

Higher purchased shipping rates and lower package volumes likely impacted FedEx Ground segment's quarterly results. The Zacks Consensus Estimate for the segment's revenue indicates a decline of 1.6% from the previous fiscal quarter.

Softness related to average daily shipments is likely to hurt FedEx Freight segment performance. The Zacks Consensus Estimate for segment revenue indicates a decline of 5.4% from the previous fiscal quarter.

KB Home $KBH

This homebuilder is expected to post quarterly earnings of $1.23 per share in its upcoming report, representing a year-over-year change of -47%. Revenue is expected to be $1.38 billion, down 19.9% from the previous quarter.

Carmax $KMX

This used car dealership chain is expected to post quarterly earnings of $0.73 per share in its upcoming report, representing a year-over-year change of -53.2%. Revenue is expected to be $7.28 billion, down 21.8% from the previous quarter.

Darden Restaurants $DRI

This owner of restaurant chains is expected to post quarterly earnings of $2.53 per share in its upcoming report, representing a year-over-year change of +13%. Revenue is expected to be $2.77 billion, up 6.3% from the previous quarter.

Patterson Companies $PDCO

The Zacks Consensus Estimate for the company's revenue for the fourth quarter of fiscal 2023 is pegged at $1.66 billion, suggesting a 1.1% improvement from the year-ago quarter, with earnings per share expected to be flat from the year-ago quarter ($2.28).

- Whose results do you care about? Let me know in the comments!

Actually, I guess I'm only interested in $ACN

Well, I can only see FedEx there for me now. I'll check it out. It won't be long before the spreadsheet's full again.

I'm only curious about the FedEx results here, the rest is beyond me.