3 reasons to buy this EV manufacturer

Electromobility is becoming a key factor in the automotive industry and brings new opportunities for shareholders. The growing demand for electric vehicles opens up investment potential for automotive companies adapting to this trend. At the same time, charging infrastructure for electric vehicles represents another area with growth potential. However, when investing in EVs, it is also important to consider factors such as regulation, battery technology developments and EV range. Currently, $TSLA is leading the industry, but what about the others?

Ford Motor Company is one of the world's leading automakers, headquartered in Dearborn, Michigan, USA. It was founded by Henry Ford in 1903 and is known for its long history of innovation and production of iconic vehicles. As one of the largest automobile manufacturers in the world, Ford operates globally, but primarily in the US.

Ford offers a wide range of automobiles, including cars, SUVs, pickups and vans. The company has made a name for itself over the years with a number of popular models such as the Ford Mustang, Ford Focus, Ford Explorer, Ford F-150 and many more. Ford is also involved in motorsports, including races such as the 24 Hours of Le Mans.

Ford $F is a misunderstood business. Investors simultaneously undervalue its highly profitable gasoline engine business, which still performs beautifully, and dismiss its enticing potential in electric vehicles (EVs). The automaker's stock could be drastically undervalued today, but perhaps not for long.

In recent years, Ford has focused on developing EV mobility and trying to reduce greenhouse gas emissions. The company is investing in the development and production of electric vehicles and offering electrified versions of some of its popular models. Ford is working to bring innovative technology and design to its electric vehicles to meet the growing demand for new and emerging sustainable transportation. Here are 3 reasons why Ford might not be a bad investment.

1. Ford Blue and Ford Pro are still solidly profitable

Ford's new format for communicating with investors has given them a chance to see how profitable its traditional automotive business is. Ford Blue, as the division is called, generated $25.1 billion in sales and $2.6 billion in operating profit in the first quarter alone .

The automaker's commercial fleet operation, known as Ford Pro, is also a cash generator. The division generated an operating profit of $1.4 billion on sales of $13.2 billion.

Both divisions expect their profitability to continue to rise. Cost-cutting initiatives at Ford Blue and a greater focus on software offerings at Ford Pro are likely to positively impact the segments' profit margins. Overall, management expects Ford Blue and Pro to report full-year operating profits of approximately $7 billion in 2023.

2. Ford E has strong growth prospects

While the company capitalizes on conventional car sales, Ford is gearing up to aggressively expand its electric vehicle operations. The auto titan is targeting sales of 600,000 EVs a year by the end of 2023 and 2 million by the end of 2026, up from less than 62,000 in 2022.

Ford expects to lose about $3 billion on EVs in 2023. But management is very actively focused on cost-cutting. CEO Jim Farley said during the company's first-quarter earnings review that Ford plans to cut production costs of its popular electric Mustang Mach-E sport utility vehicle (SUV) by up to $5,000 per vehicle by the end of the year. That should help Ford improve its profit margins, even as it cuts the price of the Mustang Mach-E by several thousand dollars to boost sales.

Ford recently reached an agreement with Tesla that will give its customers access to more than 12,000 Tesla Supercharger chargers in the U.S. and Canada. This partnership will greatly expand the number of charging spots available to buyers of Ford electric vehicles.

Of course, Tesla will get paid for this, so it's a win-win deal for both parties. "Shares of $TSLA reacted nicely to the news." This should help reduce the so-called "range anxiety" that prevents some people from buying an electric car, and thus increase the pool of potential Ford customers.

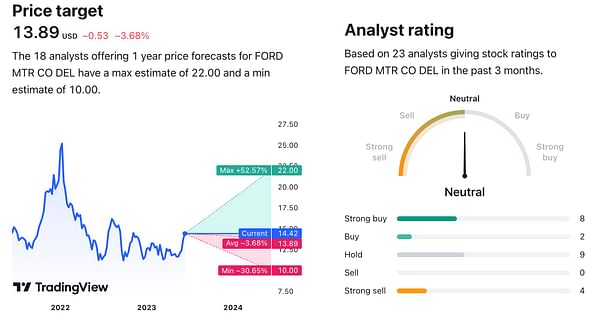

3. The stock is cheap

Ford stock can be bought for only about 5.5 times projected operating earnings in 2023. That's a bargain price given Ford's current ability to generate cash and the exciting prospects for EV-powered growth.

Ford's current stock price reflects market uncertainty that the automaker can successfully transition to an electrified future. But if the longtime car and truck maker can - and management is adamant that it can - investors could soon realize that Ford stock is significantly undervalued. That, in turn, would lead to substantial gains for those buying shares today.

At the moment, the stock is "smack dab" in the long term average, and on the face of it, there really isn't anything priced in regarding the promising future of EVs.

This is not financial advice. I am providing publicly available data and sharing my views on how I would handle the situation myself. Investing is risky and everyone is responsible for their decisions.

I used to drive a Ford, but its focus is mainly on the US. We'll see where it goes via EV.