3 growths that show no signs of slowing down and can make a lot of money

One of the most difficult decisions an investor has to make is whether to buy a stock that has recently grown rapidly and significantly in value. At the core, we all want a good deal, but buying a stock at a higher price than it was a few months ago, for example, is not always entirely easy. In the back of the mind it starts to scrap whether it is better to wait for the discounts, but this mentality leads to the investor missing out on interesting gains over time. Of course, it's not good to buy everything that's currently rising, but sometimes it's not a good thing. However, behind everything there must be a thorough analysis and decision by each investor. Here are 3 possible candidates for continued growth.

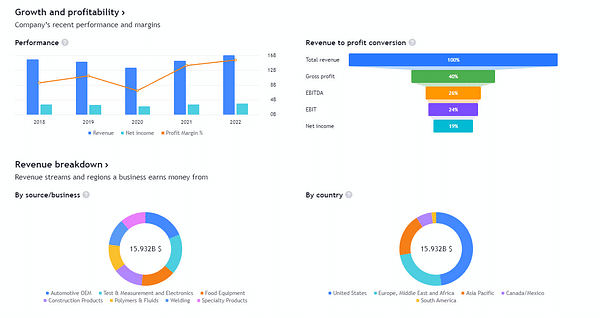

1. Illinois Tool Works $ITW

At the market close on June 15, Illinois Tool Works stock is already up 11.2% this month. The favorable jobs report and investor optimism about the economy are great news for a company that participates in several key parts of the industrial economy. So it's no surprise that ITW and other cyclical stocks are soaring.

But what sets ITW apart from other top industrial stocks is its superior leadership, diversified business and strong margins. By 2030, it aims to increase its operating margin to 30%, its earnings per share (EPS) by 9% to 10% a year, and its dividend by 7% a year.

Last year, its operating margin was 23.8% and diluted earnings per share were $9.77. The quarterly dividend was $1.31 per share. If we add these numbers for 2022 based on the company's targets and assume linear growth, we can see that it should increase its operating margin by about 0.8 percentage points per year, diluted earnings per share will more than double by 2030, and the annual dividend will increase to $9. per share by 2030.

By providing investors with a clear projection to follow, $ITW holds itself accountable for future performance. The company has done a phenomenal job so far, delivering on its promises and rewarding investors with outstanding returns.

It's also a Dividend King that has increased its payout for 52 consecutive years, a sign that investors can count on a steadily increasing payout regardless of the market cycle. Add it all up and ITW is a high-quality company worth owning for decades. And the fact that it's now on the verge of absolute peak just shows the quality of this company, which isn't stopping and has big ambitions for the future.

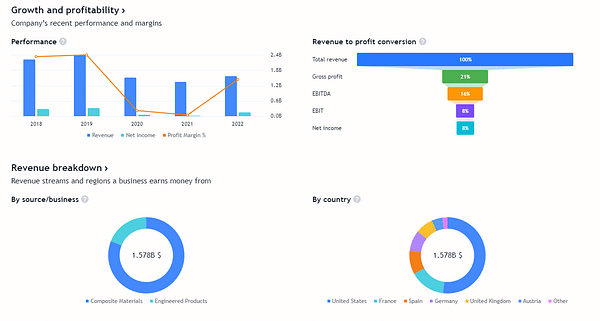

2. Hexcel $HXL

Hexcel is a leading global manufacturer of composite materials, including carbon fibre, reinforcing materials and resins. The company offers a wide range of products and services for various industries, including aerospace, automotive, energy, sports equipment and more.

The company's advanced lightweight composites are used throughout the aerospace sector, including in major Boeing and Airbus fleets such as the 737 MAX and Airbus A320neo aircraft. Hexcel also sells its composites into parallel markets in the aerospace and defense and industrial sectors in general (including wind turbines).

Composites offer a strength and weight advantage over metals, a key factor for aircraft design where weight reduction helps improve efficiency. The investment case lies in the rapidly increasing speed of production at Boeing and Airbus and the increasing use of composites on newer and redesigned aircraft. Boeing CEO Dave Calhoun confirmed that composites have been and will be a big part of every new aircraft the company produces.

Hexcel investors can therefore look forward to robust and reliable growth over the medium term as Boeing and Airbus ramp up production and meet their multi-year backlogs.

They can also expect significant growth in Hexcel's content per aircraft over the long term as the aerospace and defense industry increasingly uses composites.

In the long term, increased use of composites in wind turbines and the industry in general should come. Green energy will need these materials whether it wants them or not. Hexcel's growth is just beginning.

Thefact that the stock has not yet recovered from the covide slump may be very appealing to investors, as the growth in orders is promising and the stock could follow suit in the coming years when it has somehow not grown significantly in the last ones.

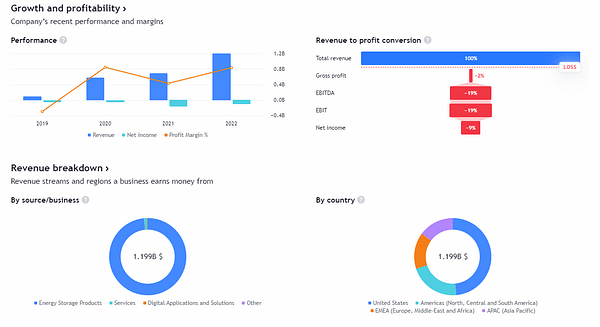

3. Fluence Energy $FLNC

With a nearly 13% increase over the past three months, the S&P 500 index has pleased investors with its strong performance. Energy stock Fluence Energy, on the other hand, has had a much stronger performance, rocketing more than 57% during the same period.

Since the company reported surprisingly strong second-quarter results in May, the market has taken notice, and it's quite possible that it will continue to gain attention and grow even higher in the coming months.

The company, which has only been on the market for a short time, beat analysts' expectations for revenue of $417.6 million, with second-quarter revenue of $698.2 million.

The company also revised upward its 2023 revenue guidance from a range of $1.6 billion to $1.8 billion to a range of $1.85 billion to $2 billion. And with a backlog of $11.2 billion, Fluence can expect strong sales in 2024 and beyond.

Renewable energy investments include more than solar and wind stocks. Energy storage systems, thanks to Fluence batteries, are also an important part of the green energy movement.

According to Rystad Energy, an energy research company, battery storage installations will have a 33% compound annual growth rate globally by 2030. For a leading battery energy storage system like Fluence, this opens up new opportunities

This is not financial advice. I am providing publicly available data and sharing my views on how I would handle the situation myself. Investing is risky and everyone is responsible for their decisions.

Too bad they are so expensive:)

A bit more expensive at the moment, but they're just quality companies...

I don't want to put too much money into grows or tech right now. I'm pretty worried that the bubble will burst sooner or later and it's going to hurt like hell. That's why I prefer value stocks now.