2 dividend stocks from a sector that will dominate the market for the next 10 years

The technology sector is commonly associated mainly with growth companies that promise investors appreciation of hundreds and thousands of percent. However, there are also quieter companies in this hot sector that can somehow make investors more excited about the long term.

Not every tech company and stock needs to be focused solely on drastic growth. Some giants have chosen a different path - a quiet and dividend-paying one. Of course, the potential of the entire industry is huge and share price growth can be a nice bonus.

Microsoft $MSFT+2.2%

Microsoft is one of the largest technology companies in the world and one of the leaders in software, cloud computing and hardware. The company offers a wide range of products, most notably the Windows operating system and the office suite.

Microsoft

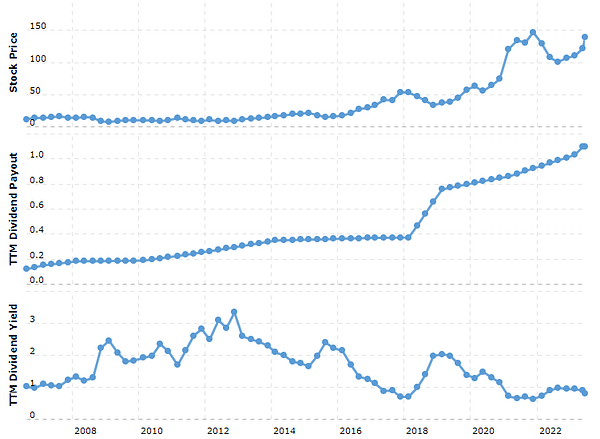

MSFTAs for dividends, Microsoft started paying them in 2004 and has increased them every year since. It currently offers a dividend yield of around 0.77%, which is not much, but it shows that the company sees dividend payments as an important part of corporate policy. Microsoft has relatively low debt and a stable cash flow, which allows the dividend to increase. It is expected to be able to increase the dividend by an average of 10% a year over the longer term.

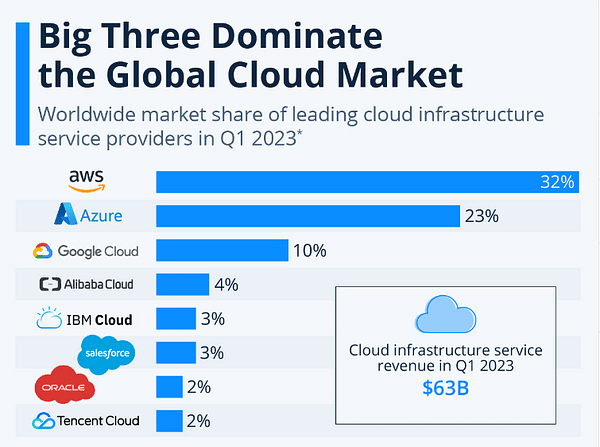

Going forward, Microsoft will be an increasingly important company, especially with cloud computing, i.e. publicly available cloud services such as Azure. Microsoft is already in the lead with companies like Amazon and Google in this area, which is the future of IT .

Microsoft is likely to continue to dictate software trends - Windows and Office will continue to be among the best sellers. As a result, Microsoft is likely to remain a leader among technology companies for years to come.

Recently, we have seen increased investor interest in technology companies focused on artificial intelligence. Many companies have started to highlight AI in their results, which has attracted investors. This has led to a rise in the shares of these technology companies. However, this growth is significantly higher than that of the other companies in the S&P 500. The seven largest technology companies in the index, such as Microsoft, have achieved an average growth of 60% this year, while the other companies have only achieved 3%. Technology companies therefore account for 30% of the index.

However, this may be unsustainable. The indices tend to revert to the mean. Each period when technology outperformed other firms was followed by a longer period when they lagged. That could happen now. So watch out for that.

Applied Materials $AMAT+3.2%

The tech sector isn't necessarily just hardware or software makers alone. It's safe to include companies that are hidden somewhere in the supply chain.

Applied Materials is an American technology company that focuses on manufacturing equipment and services for the semiconductor industry. Applied Materials products are used to manufacture chips for electronics such as cell phones, computers, and even automobiles.

Applied Materials

AMATAs for dividends, Applied Materials started paying dividends in 2012 and has increased them every year since. Currently, it offers a dividend yield of around 0.79%. The company has a stable cash flow that allows it to fund dividends and reinvest in future growth. Management expects to be able to increase dividends at a rate of 10% to 15% per year.

For the future development of the technology sector, Applied Materials will continue to be an important part of the semiconductor manufacturing supply chain. Increasingly complex chips need increasingly sophisticated manufacturing technologies, which Applied Materials offers. The company is also focusing on new technologies such as 3D chips that may bring further growth in the future.

It is likely that Applied Materials will not dominate the overall market, but will be a key supplier to companies such as Intel, TSMC and Samsung that make the chips themselves. Without Applied Materials' technology, many chip innovations would not be possible. As a result, the company is likely to cement its position as a unique specialist supplier to the entire semiconductor ecosystem in the coming years.

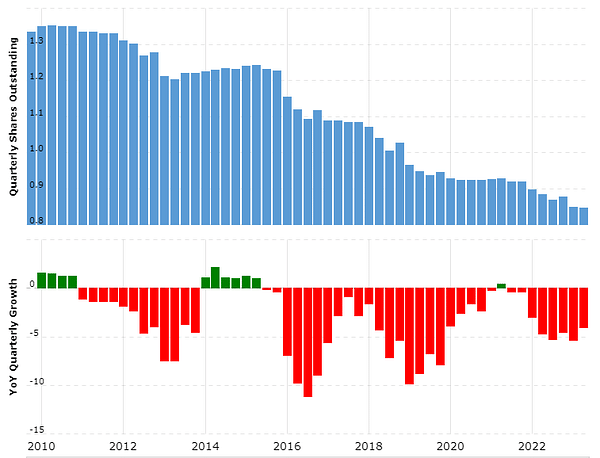

1.06 billion shares outstanding in 2017 to 845 million shares currently. The 20% reduction in share count since 2017 has done a great job of maintaining steady earnings per share growth. This is a company that certainly has capital gains in mind for the investor. Reducing the number of shares outstanding should only help dividend growth in the future.

Disclaimer: This is in no way an investment recommendation. This is purely my summary and analysis based on data from the internet and other sources. Investing in the financial markets is risky and everyone should invest based on their own decisions. I am just an amateur sharing my opinions.