These are 3 ETFs that can provide you with regular passive income

ETFs can fulfil many roles. One of them is to provide passive income - either by paying dividends or by selling part of the accumulation. Today, we'll look at 3 that are spoiling their investors with just a fat dividend.

iShares Stoxx Global Select Dividend 100 UCITS ETF $SDGP

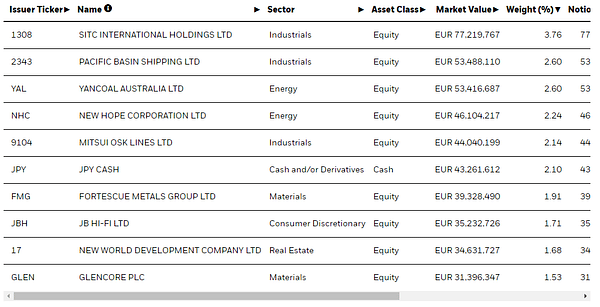

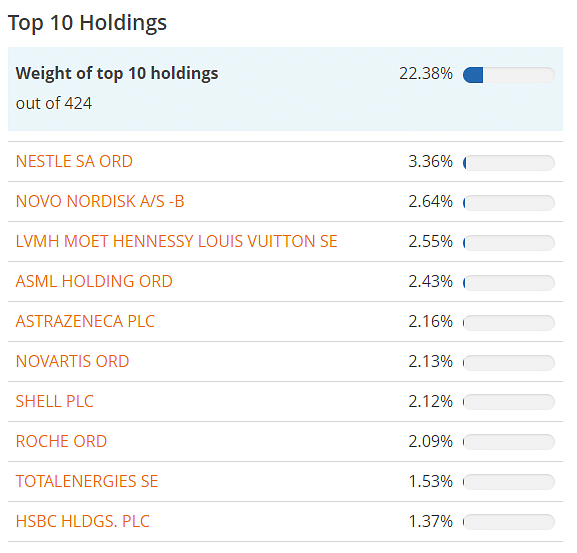

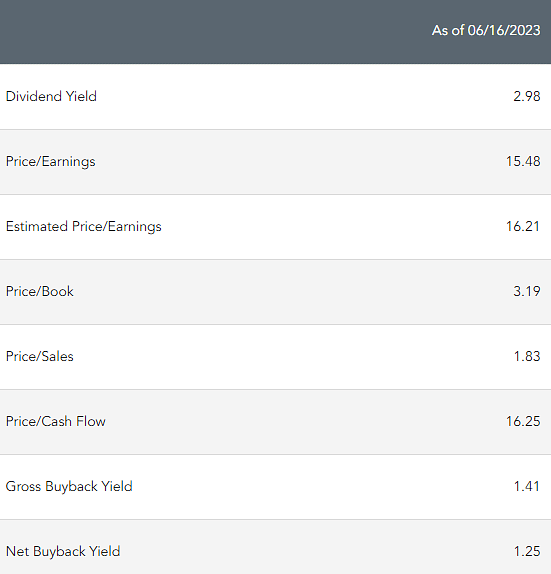

TheiShares Stoxx Global Select Dividend 100 UCITS ETF $SDGP is one of the most popular global dividend ETFs with a European registration. It invests in the 100 companies with the highest expected dividend yields in the developed markets of Europe and North America according to the STOXX Global Select Dividend 100 Index .

This ETF aims to generate relatively stable long-term dividend yields of around 3.5 to 5 percent per annum. The ETF is sufficiently diversified due to its global focus, which gives it a lower risk profile. Another very good factor of this fund is its low fees, which are only 0.4 percent of assets per year, which is below the market.

Thus, despite its global scope, it can reliably generate passive income in the form of dividends, which can help investors diversify their portfolio. Its performance in recent years has been solid, coping even with economic situations such as the pandemic crisis.

SPDR MSCI Europe Dividend Growers UCITS ETF $EUDG+1.1%

WisdomTree Europe…

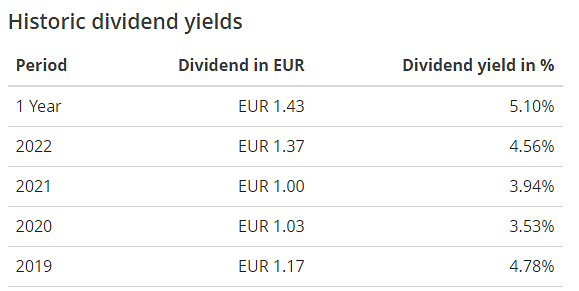

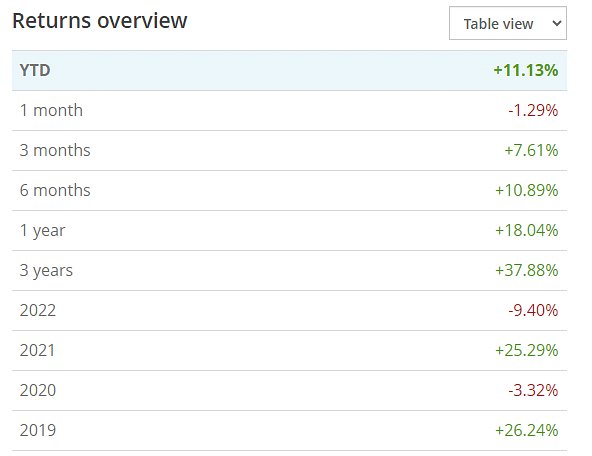

EUDGThe SPDR MSCI Europe Dividend Growers UCITS ETF is a passive European dividend ETF with a focus on dividend growers. It invests in the 100 largest European dividend growth companies as measured by the MSCI Europe Dividend Masters Index. Its top holdings include Nestle, AstraZeneca, TotalEnergies and others.

This fund focuses on companies that increase dividend payments over the long term. As a result, it is able to generate a relatively stable dividend yield of around 3-4% per annum.

Due to its focus on continental Europe, the fund is less correlated to global markets, helping to diversify the load of western equities. Other interesting features of this ETF include fees of 0.58% p.a., and good historical performance, which is on par with the MSCI Europe Index over the long term.

The main drawback may be its narrow focus, but if you are looking for a European growth dividend ETF, EUDG is one of the best options. It can help you create a passive source of income in the form of sustainably growing dividends in the European region.

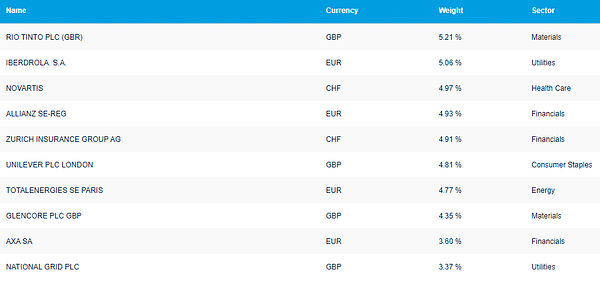

Amundi MSCI Europe High Dividend Factor ETF $EHDG

The Amundi MSCI Europe High Dividend Factor ETF is a dividend ETF focused on the European market. It invests in the 100 companies with the highest dividend yields in developed European markets according to the MSCI Europe High Dividend Yield Index. Companies held include Nestlé, Novartis, Royal Dutch Shell, TotalEnergies, BASF, etc.

Its strategy is to generate a high and stable dividend stream. These are currently between 4 - 4.5% p.a.

Other features of this ETF include:

- Low fees of 0.23% p.a., which is a great value.

- Sufficient diversification with exposure to 100 companies in the European region

- Coverage of all sectors of the European market including healthcare, consumer, utilities, industrials, etc.

- Good performance that tracks or outperforms the MSCI Europe index

The main advantage of this fund is therefore the generation of passive income in the form of high and stable dividends. Its narrow focus on the European market offers a different exposure to global dividend funds. The downsides include less diversification within the region and possible fluctuations in dividends depending on the economic situation.

Disclaimer: This is by no means an investment recommendation. This is purely my summary and analysis based on data from the internet and other sources. Investing in financial markets is risky and everyone should invest based on their own decisions. I am just an amateur sharing my opinions.