Luxury stocks - megatrends in the back and growth ahead

At first glance, it might seem that the cosmetics industry is not that interesting. Not everyone uses it on a daily basis and considered a necessity like food. But one thing to keep in mind is that the cosmetics industry is global. In December, research firm Statista published a report on the global cosmetics market. So they divided the cosmetics industry into four categories: cosmetics, personal care, skin care and fragrances. The research suggests that total global cosmetics industry revenue was $528 billion in 2022 and is expected to grow to $571 billion by the end of 2023.

The report states that personal care accounts for more than 40% of the total market. In 2022, cosmetics generated total global revenues of USD 93 billion, or 18% of the global beauty market. Statista predicts that by 2027, cosmetics will account for 19% of this market.

The growing popularity of social media, particularly platforms such as TikTok and Instagram, with Gen-Z customer data is opening up a new form of consumer engagement. By the end of 2023, nearly 28% of all beauty products will be sold online as opposed to in stores. That's a massive increase from 2020, with estimates hovering around 22%.

Coming up next is $ELF, a company that's different from all similar companies in the industry.

ELF Beauty is a US-based beauty company that focuses on manufacturing and selling affordable beauty products. The company is known for its "no compromise" philosophy that focuses on providing quality products at affordable prices.

Elf Beauty focuses on innovative products and trends in the beauty industry. Their product range includes various products such as makeup for eyes, face, lips, as well as skincare and beauty tools. The company is also committed to sustainability and efforts to reduce their ecological footprint.

Companies like $ULTA and LVMH (through its Sephora subsidiary) compete for the same variety of customers. Both companies sell similar luxury products and rely on a combination of sales in brick-and-mortar stores and online to drive sales. In contrast, $ELF sells its products to stores like Ulta, Target, Walmart, and CVS and competes with other brands on the shelves.

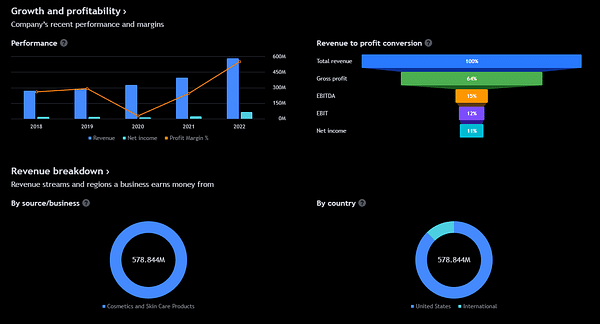

In late May, $ELF' s earnings for fiscal year 2023, which ended March 31, were released - and they were very impressive. For fiscal year 2023, e.l.f. increased its net sales 48% to $579 million and increased its gross margin to 67%, up more than 3 percentage points year-over-year. The company attributed the increase in revenue and margin to strong demand in retail, online, and pricing.

In addition, management said it has seen tremendous success with social media, particularly TikTok. The company ran four different campaigns, each of which amassed over a billion views, with the most recent reaching nearly 15 billion views.

The stock is currently trading at a nearly 52-week high with a market capitalization of $6 billion. The forward price-to-earnings (P/E) ratio is roughly 63. By comparison, other cosmetics companies that sell products online and in retail stores, such as L'Oréal and Estée Lauder, trade at multiples of 34 and 37, respectively.

For some, the current price may seem high, but this company is really growing at a meteoric pace against other competitors in the market. It goes without saying that growth is never infinite, but why not get in while you can?

This is not a financial advisory business. I am providing publicly available data and sharing my opinions on how I would handle myself in given situations. Investing is risky and everyone is responsible for their decisions.

It probably won't be anything big like LVMH, but the potential is still there. I think something could be worked out there. Looking at the chart, the price is pretty high, but the fact that they're still on the market for a short time may play a role.

In fact, I've never heard of them or their products. But I don't know if I'd want to shop that high because I don't have a handle on their market share and overall popularity here, or where they're operating everywhere and where they want to take it next. Then again, if their products are sold at Walmart, Target, etc., then I guess it appeals to customers if they stick around.