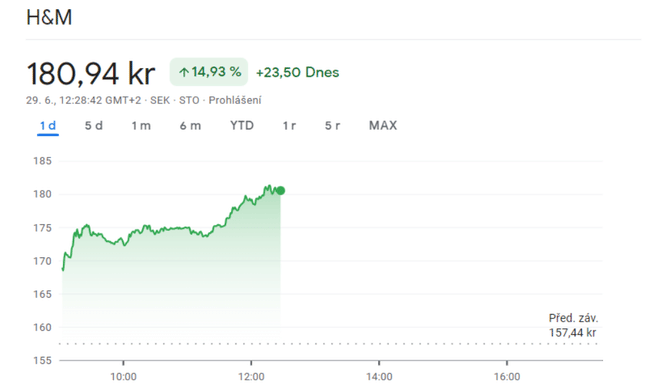

I didn't even know that H&M had stock too, so I looked at it today and I'm kinda staring. Leaving aside today's growth on the back of another strong set of results, here we see growth in sales from $187bn in 2020 to $223bn in 2022. It's also great to look at net profits, where we see growth from $3bn (2020) to $7bn in 2022 (not to mention 2021, where net profit was at $15bn).

Anyone here have their stock? What are your thoughts on this company?

Their recent growth is mainly due to a change in strategy. They are focusing more on selling their more expensive brands, targeting customers who are less vulnerable to the rising cost of living, and it's working out nicely for them too.

Nominally it looks nice, but when you take the revenues/profits, the margins show me that it's just plain retail without any moat. After 20 years, the stock would deliver you an appreciation of about 47% versus the spy's 300%

That's what I'm staring at. I know HM, of course, but not as a public limited company. Ytd 62% is unbelievable. It's also news to me that it's a Swedish company.

I know the company, but it's not something I'd like to invest in. On the whole, the results look like a seesaw to me. Even though we've seen growth in recent years, it's kind of a downturn from 2021. But they're doing well to combat the declining number of shoppers, I'll give them that.

It's really admirable how beautifully they are fighting the adversity. The outperformance is mainly on the back of price increases as sales are down.