2 ETFs to perfectly diversify your portfolio

Diversification is key for many investors. Invest in a sector, a technology or perhaps a geographic area? How about betting on the whole world? These 2 ETFs will help you do just that!

Worldwide diversification is a rather interesting option to eliminate really any fluctuation. On the other hand, it's the purest "going with the crowd". Which ETF to choose for this? And why?

There are several reasons why investing in global all world indices and ETFs tracking such indices is a good idea.

Diversification. All world funds invest in thousands of stocks across markets and sectors around the world. This provides a high level of diversification and reduces risk in your portfolio.

Access to global growth. The global economy is growing and all world funds allow you to participate in that growth. You don't have to rely solely on the growth of one market or region.

Low costs. Index fund managers like Vanguard and iShares offer low-cost all world ETFs.

Simplicity. Instead of building a portfolio on a market-by-market basis, you can own just one all world fund and automatically get global diversification. It's a more conservative and simpler strategy.

Performance. Over the long term, all world funds provide decent appreciation with relatively low volatility thanks to global diversification. They typically perform around 8-10% over the long term.

Vanguard Total World Stock ETF $VT

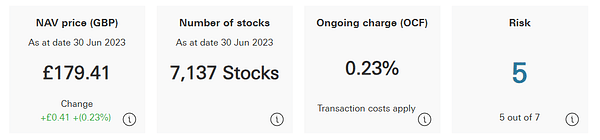

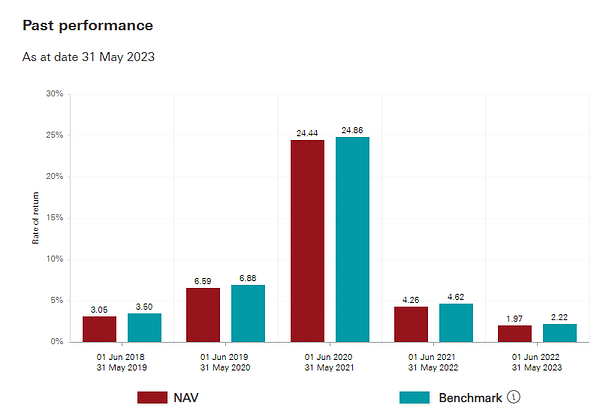

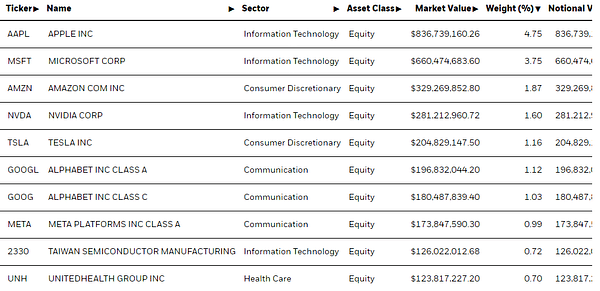

The Vanguard Total World Stock ETF is a passive global equity exchange traded fund. It tracks the FTSE Global All Cap Index and provides investment exposure to stock titles around the world.

This ETF holds more than 7,100 stocks from developed and emerging markets around the world. It trades on the NYSE Arca exchange. The FTSE Global All Cap Index, which it tracks, includes large, mid and small cap stocks from the U.S., developed European markets, Japan, Australia, newly industrialized economies as well as emerging market countries. This gives the VT ETF a truly global exposure.

The FTSE index that it tracks assigns weights to individual markets based on their relative size, providing a representation of the world's traded stocks. The weighted average maximizes the diversification effects on overall performance.

The VT ETF offers a low expense ratio of 0.23% per year, which is solid. Over the past 10 years, it has returned 10.48% with relatively low volatility. It provides investors with the ability to manage global exposure through a single fund (ETF). It can thus be part of the global component of an investor's portfolio, covering markets outside the US.

iShares MSCI ACWI ETF $ACWI+1.1%

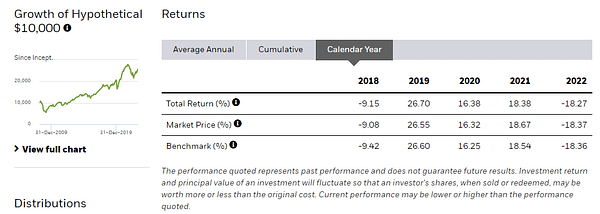

The iShares MSCI ACWI ETF is a passive global equity exchange traded fund. It tracks the MSCI All Country World Index and provides investment exposure to developed and emerging markets around the world.

The diversification here is REALLY broad. The fund invests in more than 2,250 stock titles from over 45 developed and emerging markets - including stocks of companies from the US, Canada, Japan, the EU, China, India and many other countries. Compared to funds focused only on the U.S. or developed markets, the ACWI ETF offers an even greater global spread.

The ACWI ETF is a good way to gain exposure to the entire global economy and benefit from growth in emerging markets. It tracks the established ACWI index, which is composed to reflect the relative importance of each market based on market capitalization. This ensures maximum diversification and representativeness.

The fund has low expenses of 0.32% per annum, making it attractive to long-term investors. Over the past 10 years, it has returned approximately 12% per annum with comparable volatility to the broader market. This fund offers an easy way to add global exposure to your portfolio.

The ACWI ETF is mainly owned by institutional investors and asset managers for its diversification opportunities and exposure to new growth stories in markets outside the US. Its design allows for considerable stability while maintaining sensitivity to global economic developments.

Disclaimer: This is by no means an investment recommendation. It is purely my summary and analysis based on data from the internet and other sources. Investing in the financial markets is risky and everyone should invest based on their own decisions. I am just an amateur sharing my opinions.