Caterpillar Inc (NYSE: CAT), a solid player in the global heavy equipment industry, recently attracted attention with the unveiling of its entry into the electrification space at CES 2024. With a history spanning nearly a century, Caterpillar has remained a consistent leader and continues to come up with innovations in construction, mining and industrial equipment. Investors are naturally taking notice, and $CAT stock is up more than 20% this year.

About the Company:

Caterpillar Inc. is a leading global manufacturer of heavy equipment, including construction and mining equipment, off-road diesel engines and industrial gas turbines. With nearly a century of history, Caterpillar specializes in innovative products and services that play a key role in the world of construction, mining and industrial sectors.

Innovation at CES 2024:

The Consumer Electronics Show (CES) is a prestigious event in Las Vegas where companies showcase the latest technology products and innovations. At CES 2024, Caterpillar plans to showcase its two innovative electric machines. The underground loader with payload, zero emissions, advanced on-board battery and fast charging will get the most attention. In addition, Caterpillar will showcase a battery-powered mini excavator.

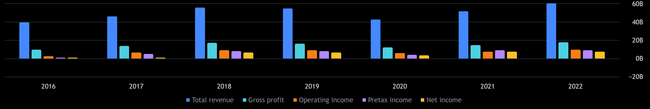

Financial performance:

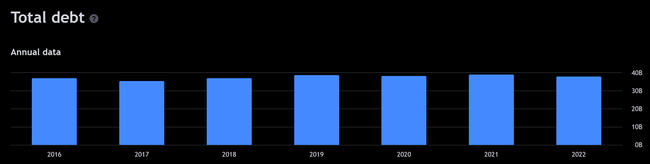

Caterpillar's financial performance has been very robust over the past few years. In 2022, earnings per share reached $12.64, a 6% increase from 2021. The company's 2022 revenue reached $59.4 billion, a 16.5% increase from 2021. overall, revenue, earnings, and assets have been growing over the long term. The dividend is currently around 2%. The downside here is the high debt which was $37.5 billion in 2022.

Share price development :

Shares of $CAT have been rising very solidly over the long term and for this year, $CAT stock is up over 20%. The P/E is currently 16.8, which is ideal. There have been some nice buying opportunities this year and I personally have taken advantage of those opportunities. To find out the fair price, I recommend taking a look at the Fair Price Index here at Bulios.

Competition:

Caterpillar faces competition in the heavy equipment sector from companies like Komatsu, Volvo and Deere & Company, all vying for market share. Caterpillar's long-standing reputation for reliability coupled with its commitment to innovation puts it in a strong position in the industry.

Komatsu: Japanese giant Komatsu is a top manufacturer of construction and mining equipment, producing excavators, loaders and other industrial equipment.

Volvo: Swedish company Volvo specialises in the manufacture of trucks, construction machinery and industrial engines, offering a wide portfolio of transport and construction equipment.

Deere & Company: Deere & Company, known as John Deere, is a leading manufacturer of agricultural machinery, producing tractors and combines to support modern agriculture.

Pros and Cons:

Advantages:

- Innovation: Caterpillar's focus on innovation is evident in the electrification environment, showing a commitment to sustainable practices.

- Global Presence: With a presence in more than 180 countries, Caterpillar benefits from a large and diverse market base.

Disadvantages:

- Dependence on Economic Conditions: the company's performance is closely tied to economic cycles, which means sensitivity to downturns in construction and mining activities.

- Transition to Electrification: Despite the promising move, the transition to electrification presents challenges in terms of infrastructure and operational adjustments.

Conclusion:

Caterpillar's diverse product portfolio and global reach offer investors exposure to different industries and markets. The company's turn toward innovation, showcased at CES 2024, positions it well for the future of sustainable engineering.

Disclaimer: This is not an investment recommendation. This article is just a summary of my information and analysis based on information and data from various sources. Investing is risky and each investor should do their own analysis and their own opinion on a given company or stock.