Today we have the most important report of the week, inflation.

We should hear the new numbers in the morning (in the US), so for us it will be in the afternoon. But I'll start today with a post on this topic. 😊

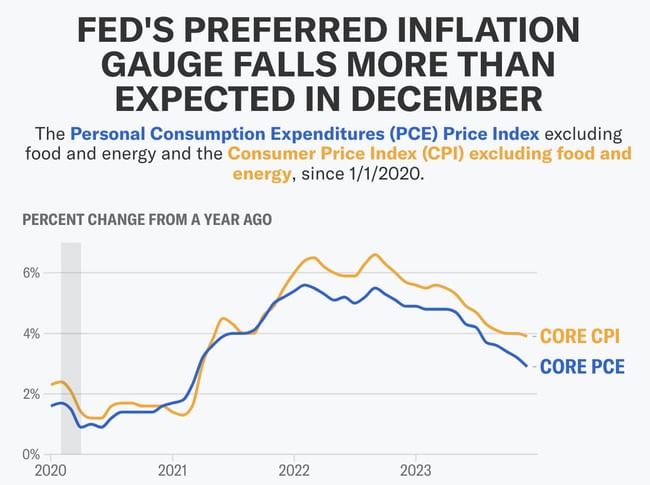

According to Bloomberg analysts, headline inflation is expected to stall at 2.9%, down significantly from December's 3.4%. If these estimates come true, it will be the lowest annual inflation rate in about three years and the first time the number will fall below 3% since March 2021.

This news could be positive, but where I see uncertainty in the months ahead is that we still have high prices for services and products. The market is still strong and that could stabilize inflation around these levels for some time and that's something the Fed doesn't want.

I don't think it's easy for him now because a quick rate cut would shoot the markets even higher and pour a lot of new money into the economy, on the other hand a long hold at these levels could again fuel talk of a recession. Further, I note that there is already talk that the first cut won't come until June, with pretty much the market expecting something in the neighborhood of 60% to come in May.

So I'm curious to see where we move and especially what numbers come in, I look forward to the news and our discussions this evening as well. I personally would welcome some of that correction in the tech sector, but I think there is a lot of strength there and the high rates are not having much of an impact yet, but I worry about other sectors like Reits where it's been pinched for a long time and possibly smaller banks. What about you? 😊

I'm very curious to see what numbers today will bring us and for the discussions :)