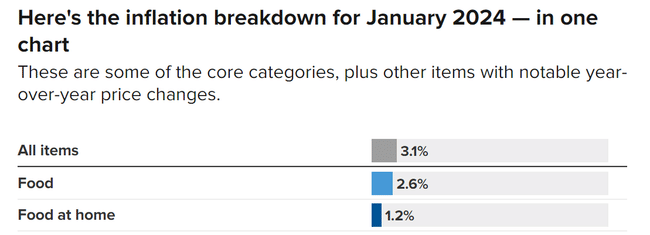

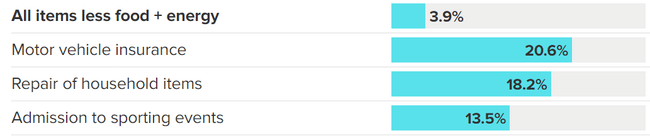

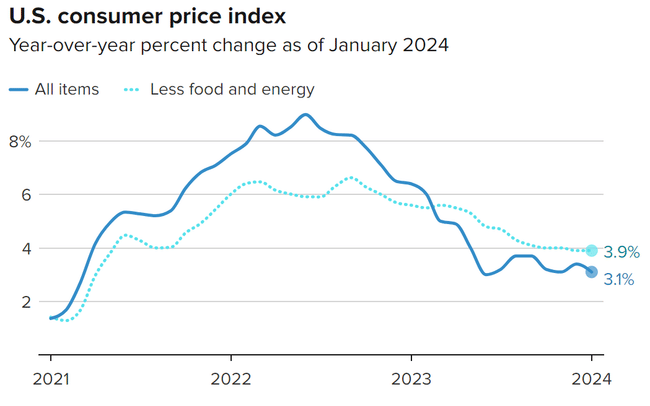

Although the fall in inflation to 3.1% in January represented some moderation compared with December and workers' purchasing power was rising, some sectors still signalled possible risks, which called for cautious monitoring of developments in the economy.

Despite the overall decline in inflation, some sectors are seeing growth. Among the "important" categories is food, motor insurance, household goods and sporting events. However, analysts suggest that this growth is only short-term. Following the report, the index fell slightly THE SP500 $^GSPC, down less than 2%.

"In all this data you get zigs and zags and this was just a zig. Bottom line: inflation continues to moderate. It's still uncomfortably high even though it's going in the right direction and all the trend lines still look good, notwithstanding the January data detour."

Mark Zandi, Economist

Economists estimate that price growth in housing is likely to increase in the coming months to moderate, as the price of newly signed leases gradually declines, which is a positive indicator.

It is also important to recognise and look back, as Covid-era inflation has fallen significantly from its peak. During the worst months, inflation was as low as 9.1%.

Inflation for January 2024 therefore provides a mixed picture of the state of the economy. While there is a slight decline overall, certain sectors are still are showing growth. It is thus important that FED to monitor further developments with respect to market stability and safeguarding consumer purchasing power.

Disclaimer: You will find a lot of inspiration on Bulios, but stock selection and portfolio construction is up to you, so always do a thorough analysis of your own.