The US Federal Reserve has expressed considerable concern about the potential risks associated with cutting interest rates too quickly. The minutes of the meetings held on 30 and 31 January indicate that the Fed is uncertain about the appropriate timeframe for maintaining interest rates.

According to a report released this week, a majority of meeting participants expressed concern about the potential risks associated with cutting interest rates too soonwhile uncertainty remains about the appropriate timing for a change.

Investors' expectations of of a possible rate cut in the near future were thus dispelled following expressions of caution from Fed Chairman Jerome Powell and other officials.

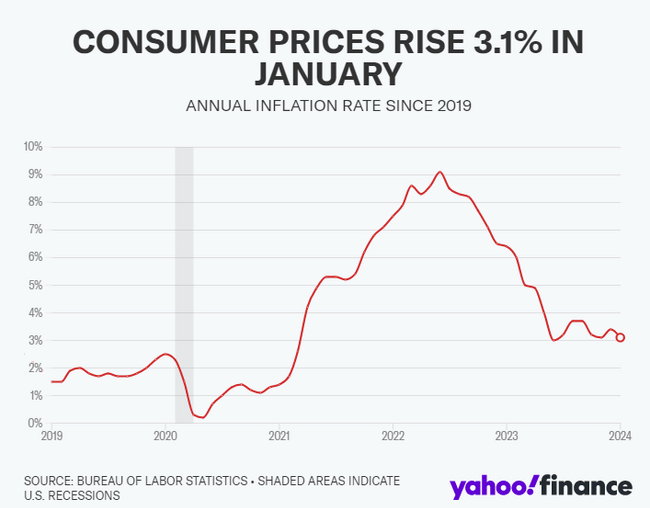

It was stressed that maintaining a restrictive approach to monetary policy was necessary for achieving the inflation target of 2%as set by the Fed.

Although several participants pointed to the possible risks associated with maintaining a long-term an overly restrictive stance, most agreed on the need for greater confidence in a decline in inflation before interest rate cuts were considered.

Economic indicators released since the Fed's last meeting suggest that inflation and employment are more or less stable, providing a slight relief for investorswho are awaiting possible changes in monetary policy.

However, the conclusions of this meeting suggest that the Fed remains cautious and will likely continue to monitor developments and data beforehand, before making any steps towards adjust interest rates.

Disclaimer: You will find a lot of inspiration on Bulios, but stock selection and portfolio construction is up to you, so always do a thorough analysis of your own.

Source.