Investment bank RBC Capital estimates that shares in AFC Energy, a company specialising in hydrogen fuel power generation technology, could more than double in the next year. Even so, they admit it is a risky bet.

AFC Energy and its potential

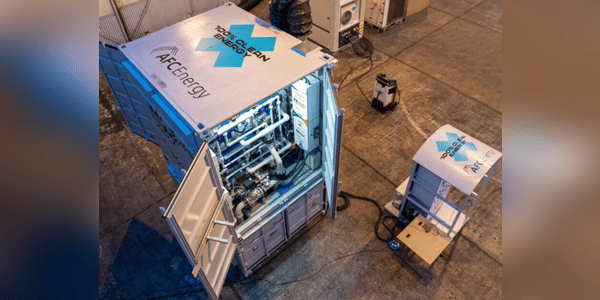

Founded in 2006 and listed on the London Stock Exchange,AFC Energy $AFC.L makes hydrogen fuel cells for off-grid power generation in applications such as construction, mining and transportation. Despite the stock's decline from its all-time high in 2021, RBC Capital sees great potential in the company's continued business momentum, which is not reflected in the current stock valuation.

Expected growth

RBC analysts Erwan Kerouredan and Victoria McCulloch said in a June 11 research note that AFC Energy is on the cusp of significant growth. Although they have an "outperform" rating on the stock, they warn of "speculative risk." The investment bank expects the stock to rise 159% over the next 12 months to 40p per share, the most conservative price target…