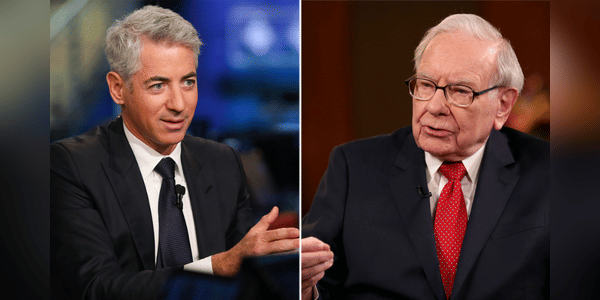

There have been some interesting investment decisions in the financial markets in 2024. Some of the world's best-known investors, including Warren Buffett, Bill Ackman and Michael Burry, have focused on stocks they considered undervalued. Although each of these companies faced challenges, these investors saw opportunities that they thought were too good to pass up.

In the following lines, we'll look at three stocks that caught their attention in the second quarter of this year: Ulta Beauty, Nike, and Shift4 Payments.

Ulta Beauty $ULTA: YTD - 22.19%

Ulta Beauty stock experienced a sharp 22% decline in 2024, presenting an enticing opportunity for investors like Warren Buffett. Buffett's investment company, Berkshire Hathaway, opened a position worth approximately $260 million in the second quarter of this year. While this investment represents only a small part of his overall portfolio, it is an important signal.

Ulta Beauty shares are now trading at less than 15 times earnings,…

There are many opportunities for investors to make investment decisions in 2024. These billionaires like Warren Buffett, Bill Ackman, and Michael Burry have deep market understanding and strategic thinking. If anyone wants to learn more about these investment strategies they can get https://uaeassignmenthelp.ae/mba-project-writing for their assignments.