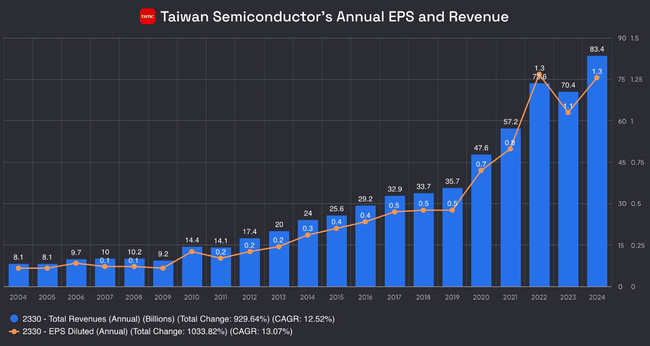

An incredible performance by $TSM. Revenues in 2024 will reach $83 billion, up from $8 billion in 2004. But do you think the current pace is sustainable? For the next couple of years I guess it's clear, but what's next? Is anyone keeping TSM here for the long term?

Great company, so far I only have $ASML and $NVDA from this industry. TSM is pretty high right now and we'll mostly see how the US election goes as it may affect a lot of things too.

The results were great and I regret not having their stock in my portfolio. If the price had dropped significantly, I would have bought.

The results are great, but the valuation is high and the stock is really way undervalued, so I'll wait for a better price.

You can see that the company is doing well, but I see a risk from China, because if China were to attack, it could be a big problem.

The results were great. I have $ASML in my portfolio and would like to buy $TSM as well.

I was buying around 80 shares and got rid of them after the results we've had now. The growth was too much.

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

$TSM stock makes me really happy :) I've held the stock for a little over a year and gained a nice 195%

Semiconductors are a very cyclical sector, so over time it will surely go sideways or down, but currently they are doing very well and as long as its customers will thrive so they will benefit from it.

With each additional fab built outside of Taiwan, the "Chinese" risk will decline and their valuation will approach fer values. But they will keep most of the most advanced production as a silicon shield on the islands, so it is possible that once in a while the market will get cold again and there will be an opportunity to take advantage of significant discounts (I have a couple of pieces for 65-100usd).

I already have a large part of it after the time test, it is currently my largest individual position, so maybe I will eventually pour some into an index ETF.

Semiconductors are a very cyclical sector, so over time it will surely go sideways or down, but currently they are doing very well and as long as its customers will thrive so they will benefit from it.

With each additional fab built outside of Taiwan, the "Chinese" risk will decline and their valuation will approach fer values. But most of the most advanced production will be kept as a silicon shield on the islands, so it is possible that once in a while the market will get cold again and there will be an opportunity to take advantage of significant discounts (I have a few pieces for 65-100usd).

I already have a large part of it after the time test, it is currently my largest individual position so maybe I will eventually pour something into an index ETF.