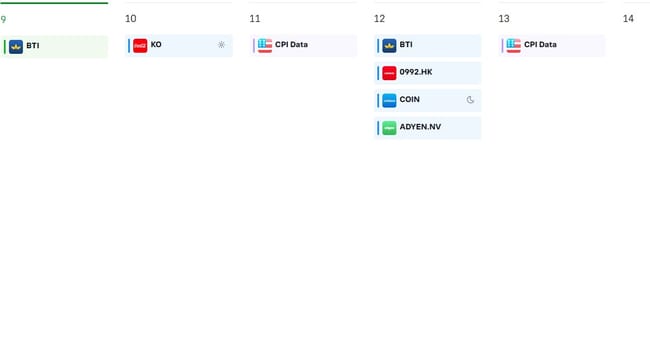

Results from companies in my portfolio this week

This week brings results from several key positions in my portfolio. Here is an overview with my take on each, supported by a rationale.

$KO : I expect a standard report with minimal surprises; in turbulent times this is a stock that holds its value and serves as a safer haven. Rationale: Consensus estimates Q4 2025 EPS $0.57 (+3.6% YoY) and revenues $12.05 billion (+4.4% YoY), reflecting resilient demand for staple products in volatile conditions with stable margins.

$BTI : Basically the same as $KO — an attractive dividend and a safe stock in turbulent times. Rationale: With estimated Q4 2025 EPS $2.51 and a reliable yield around 5%, BTI provides stability thanks to its defensive tobacco business and diversification into next-generation products, with expected 2% revenue growth despite market headwinds.

$COIN : I expect a big move either up (which would require stellar results and a reversal in market sentiment) or down (if results are neutral or poor and sentiment remains as it was last week). Rationale: Consensus for Q4 2025 EPS $1.03 (-66% YoY) and revenues $1.85 billion (-19% YoY) could trigger volatility given the crypto market’s sensitivity; only a strong beat could reverse sentiment.

$ADYEN.AS : Whatever the results, I expect this stock to remain relatively unchanged. Only a change in market sentiment would push it up (and I hope it would pull $PYPL from the same sector up with it); there’s not much left that can push it down. Rationale: significant revenue growth, sustained high profitability, and an attractive current valuation.

$0992.HK (Lenovo): I expect good results, but if the market doesn’t start liking tech and electronics manufacturers again, it will be difficult. However, the $9 level should hopefully hold. Rationale: Estimated Q4 2025 revenues $16.98 billion (+8% YoY) and EPS $0.05 (-64% YoY) reflect growth driven by AI. The issue remains market sentiment and possible problems related to trade wars.

- At least a small bit of joy in these times — $BTI pays a dividend today! BTI’s quarterly dividend of $0.75 is payable on February 9, 2026, offering a forward yield of 4.9%, which provides income stability in these volatile times.

Your thoughts on these reports, please! Which of these stocks are you watching? What are your expectations?

I'll be very interested in inflation, because it can change a lot of things again.

Have you ever considered replacing $KO with $PEP? Pepsi has performed better and has been doing better in recent years.