3 ingenious stocks that will give you a fat passive income without much effort

Choosing the right stock is an eternal topic. All the more so when it is a relatively long-term investment, ideally designed to provide passive income in the form of dividends in the future. Today, I'll try to look at three stocks that, by virtue of their business, name and quality, are often the choice of long-term investors.

Of course, it's worth mentioning at the outset that passive income in the form of dividends can be built up in different ways. Logically, the equation is higher dividend = higher income. But this is not necessarily true. As we often mention here - a high dividend yield is not necessarily good. The sustainability of the dividend, the fundamentals and stability of the company, and of course the potential for share price growth are also important. If a company pays a dividend but has nothing to pay it out of next year, or it falls 95%, we certainly haven't earned a stable passive income. But now to the stock.

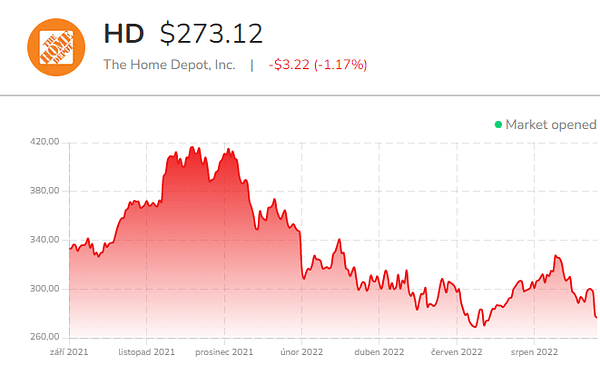

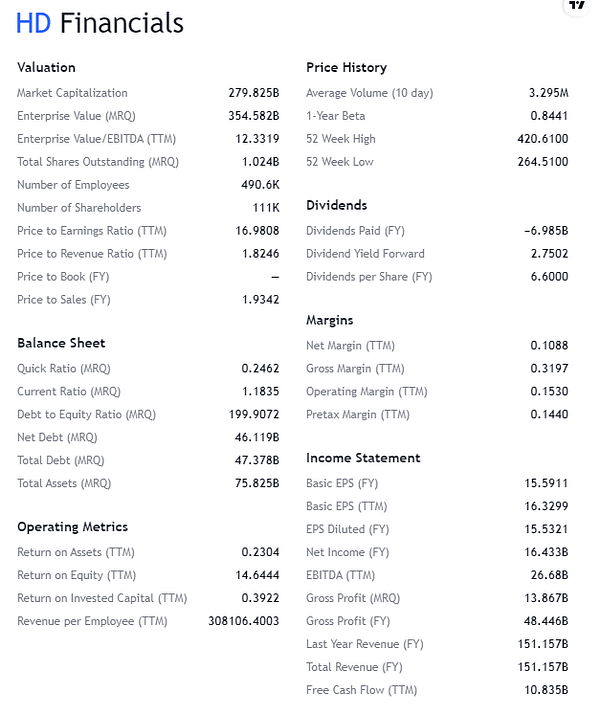

Home Depot $HD-0.8%

Home Depot is the world's largest home improvement retailer. At the end of the most recent quarter, the company operated a total of 2,316 retail stores in all 50 U.S. states. That's an incredible number. Home Depot even reported better-than-expected results for the second quarter of 2022.

In the report, the retail giant posted earnings per share of $5.05 on revenue of $43.8 billion. In contrast, consensus estimates for the second quarter called for earnings of just $4.95 per share on revenue of $43.4 billion. The company continues to estimate fiscal year 2023 earnings of approximately $16.31 per share on revenue of $155.69 billion.

HD marked the 142nd consecutive quarter that the company paid a cash dividend. In the same announcement, the company announced a $15 billion share repurchase program. I think every investor likes to hear that.

https://www.youtube.com/watch?v=GRL-21CNn6E

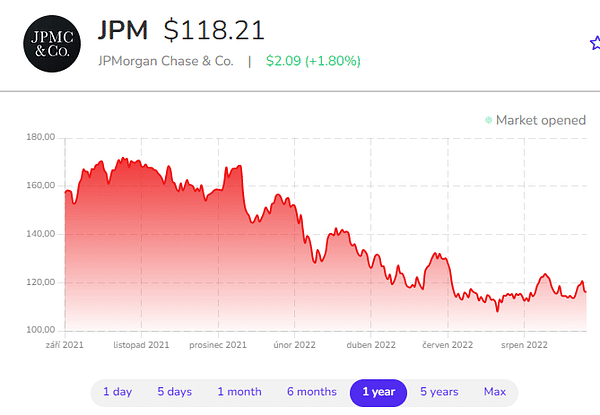

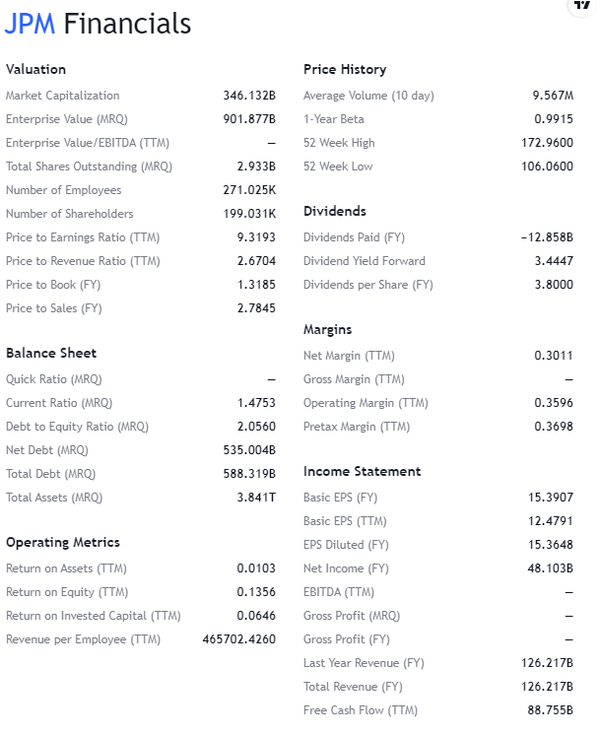

JPMorgan Chase & Co. $JPM+0.0%

The following company, JPMorgan Chase & Co, is a well-known bank and financial services holding company. Its size (and therefore stability) is almost unbelievable. To give you an idea of scale: as of March 31, 2022, the company had assets of over $4 trillion and equity of $285.9 billion. In addition, JPMorgan Chase provides investment banking and financial services to a wide range of customers.

The latest results looked like this: This quarter, JPM had $30.7 billion in credit costs. Credit costs were $1.1 billion, which includes net provisioning of $428 million and net charge-offs of $657 million. They also had $1.6 trillion of liquidity resources. What's more, in the second quarter, JPM distributed a dividend of $3 billion, or $1 per share. It also repurchased $224 million worth of stock in the quarter. JPM's annual dividend yield is currently 3.37%.

Of course, banks and financial services are and will continue to be a perfectly valid and promising industry. No major upheavals are to be expected here. JPM summarizes statistics from its industry - In consumer and community banking, combined debit and credit card spending rose 15%, while travel and dining expenses remained high. Credit card spending increased 16% with continued strong growth in new account openings.

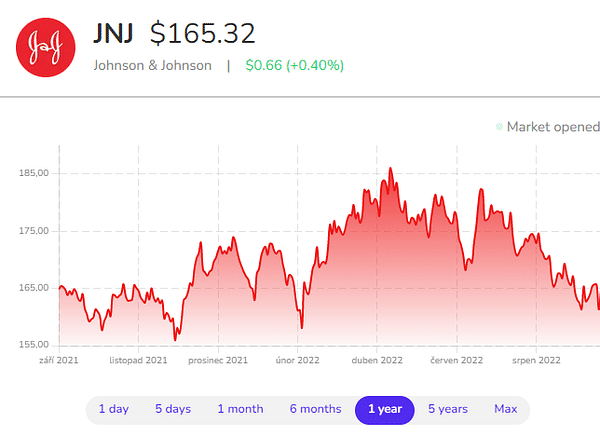

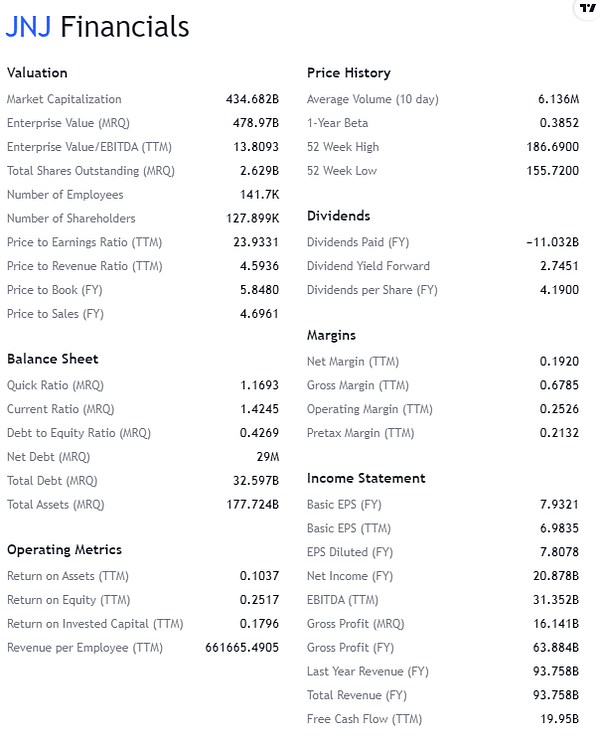

Johnson & Johnson $JNJ-0.8%

Johnson & Johnson is an extremely diversified healthcare company that offers investors a wide range of options. The company has a long history of dividends and has raised its payout for 54 consecutive years.

JNJ is clearly one of the most frequently mentioned companies in connection with dividend and stability. This is due to its history, strength and huge diversification across all corners of the sector. It is also often the one driving forward developments in the pharmaceutical waters.

It also frequently attends major scientific conferences where it often publishes new data sets and future plans for parts of its pipeline. This year's AASLD Liver Meeting 2022 in Washington D.C., which takes place from November 4-8, could be a big catalyst for the company, as it could be in a position to disclose some exciting new results for liver drug candidates that look quite promising.

That's a positive, of course, but it's a completely marginal drop in the ocean from this giant's perspective. The company benefits massively from its established products.

Further analysis also here:

https://www.youtube.com/watch?v=iqSKkTiORNw

Do you have any of the stocks mentioned in your portfolio or on your radar? Are you considering any, or perhaps waiting for better prices?

If you enjoy my articles and posts, feel free to throw a follow. Thanks! 🔥

Disclaimer: This is in no way an investment recommendation. This is purely my summary and analysis based on data from the internet and a few other analyses. Investing in the financial markets is risky and everyone should invest based on their own decisions. I am just an amateur sharing my opinions.