The global water crisis is coming, how to invest in water? part 2

Water is not given much attention, but it is a vital resource for human life as well as for production processes. Its scarcity poses a significant risk to various industries such as: semiconductor manufacturing, the food sector, textile production, as well as mining and many others... It can also be an attractive investment opportunity, and we will discuss the opportunities in the form of companies worth investing in in this paper.

Water as an investment opportunity, part 2.

A quick summary to make us aware of the importance of water

The oceans make up 97% of the Earth's water. The majority, 2.5% of the planet's fresh water, is locked up in polar ice caps, in the soil or is irreversibly polluted. This means that as of now, 0.5% of all the water on the planet is potentially usable by humans, animals and plants, which is really quite low, wouldn't you say?

To begin with, water is a commodity that will always be needed. This is especially true as water crises are emerging in a number of countries, including the United States. In several Western countries, a multi-year drought may require the government to cut water consumption by up to 25%.

There should be no doubt about water from an investment point of view at all, in my opinion, and when there is an opportunity to do so in the form of dividends it can be a win-win situation. In volatile markets, as they are now, it is always good to invest in companies that pay you to own their shares.

And then there is the current "risk" environment. In light of all of these factors, you can see why dividend stocks are the watering hole between growth and value. Many of these stocks outperform the market simply because of the laws of supply and demand.

I discussed the importance of water as an investment alternative in more depth in an article that was a great success, so I am including it here: the global water crisis is coming, how to invest in water? Since 76 out of 89 people responded in the last poll that they would like more articles on water and investment options we will describe other companies that are interesting.

https://www.youtube.com/watch?v=aYeEBbdm_mc

1. American Water Works $AWK+0.1%

American Water Works is one of the leading water companies in the country. The company's current dividend yield is 1.77%. That's not very impressive, but it's good, at least above average. The company has a profit margin of 3.99%, which is almost double the industry average. And with a price-to-earnings (P/E) ratio just above 20 times, AWK stock's valuation becomes more attractive.

American Water Works Company, Inc. through its subsidiaries, provides water and wastewater services in the United States. It offers water and wastewater services to approximately 1,700 communities in 14 states and serves approximately 3.4 million active customers. In addition, the company operates approximately 80 surface water treatment plants, 480 groundwater treatment plants, 160 wastewater treatment plants, and 52,500 miles of transmission, distribution and collection pipelines and 1,100 groundwater wells or 1,700 water and wastewater pumping stations, 1,300 treated water storage facilities and 76 dams. It provides drinking water, wastewater and other related services to approximately 14 million people in 24 states.

2. Mueller Industries $MLI-1.3%

If you're attracted to investing in a company that's undervalued but growing, you'll like this company. Mueller Industries is the first company in this post that is not a water company. However, the company is vital to water infrastructure. The company manufactures pipes, valves, and fittings for commercial and residential applications. In the most recent quarter, Mueller generated record revenue of $1.15 billion. The company stands out because it has zero net debt and continues to increase its free cash flow.

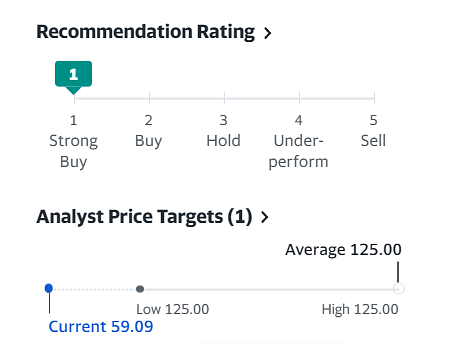

Yahoo Source. Finance

I haven't seen a rating like this in a long time: the Strong Buy rating says it all, and the potential of this company is followed by the price prediction for this stock, where analysts are predicting an average price as high as $125, which is more than 100% upside.

3. Xylem $XYL+0.8%

The last stock on this list of water stocks with the highest dividends is a company that uses technology to address the emerging problem of water scarcity. Xylem claims that within the next three years, 1.8 billion people will live in areas without enough water. To this end, the company is delivering hundreds of innovative and smart technology solutions.

Xylem Inc. and its subsidiaries are engaged in the design, manufacture and service of engineered water and wastewater products and solutions in the United States, Europe, Asia Pacific and internationally. It operates in three segments: water infrastructure, applied water, and measurement and control solutions.

The growth of this company is expected to be driven by the forced modernization of water infrastructure. Therefore, analysts estimate solid growth for this company as well as dividends.

Each investor must make up his own mind, but in my opinion, water is very interesting, whether because of its necessity for the existence of mankind or for production processes. It does not receive as much attention as, for example, oil, gas or energy as a whole, and yet you can see the statistics at the beginning of the article, which speak clearly. With this post I just wanted to point out an interesting opportunity in the form of water, so don't see this as investment advice, just analysis from a retail investor.

If you like this post about water, you can give me a follow :)