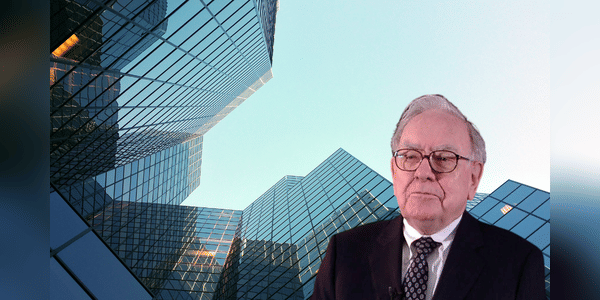

Warren Buffett has a wealth of experience and knows what path to take to keep beating the market. But are there any stocks and sectors he avoids like the devil? Yes, definitely! One of them, for example, are the uncertain bets, which Warren really doesn't recommend in the long run. Which specific stocks does Buffett think should therefore have no place in investors' portfolios?

Warren Buffett's long-term investment strategy has worked in virtually every market condition over the past few decades - recession, high inflation and deflation. If anything has made Buffett one of the most successful investors in history, it is his strict adherence to his principles. Buffett has maintained his relatively simple strategy of picking solid companies and focusing on long-term growth, while somehow ignoring the noise that drives most investors to panic. So what I keep writing here - Stay Calm 😜

That said, I guess his strategy could be described as …

how am I good at trading, stocks, choosing a classy broker

Please help me