The conflict in Ukraine has been going on for more than 200 days now, and in that time Ukraine has suffered quite a lot, both the country itself and various societies. The sanctions against Russia are also leading to global problems in the supply chain, and this is showing in the performance of companies. Ukrainian companies have been significantly affected, along with international companies that operate commercial enterprises in Ukraine.

How to invest in Ukraine?

The U.S. invasion of Ukraine has affected global markets in 2022, which has only worsened an economic situation that is already fraught with rising inflation and supply chain issues. Commodity prices have been rising steadily, while company shares are mostly falling,

Why invest in Ukraine?

Apart from agriculture, Ukraine has other strengths in terms of business. The country has a population of 43-44 million, currently difficult to measure, but has over 200,000 software developers. Because of the lower salaries and high quality of developers, many international companies have hired employees in Ukraine. Innovation and growth in the Ukrainian technology industry should be a compelling reason to consider investing in this sector of the global economy.

As the conflict continued, these Ukrainian companies demonstrated their strength and resilience in how they responded to the war. Many continue to operate despite all the challenges. Many technology companies with Ukrainian subsidiaries continued to operate during the conflict after ensuring the safety of their employees.

As for putting your money into Ukraine, you have 2 options either in the form of donations or investments.

ETFs linked to Ukraine

- TheFlexShares Morningstar Emerging Markets Factor Tilt Index $TLTE- The index is designed to reflect the performance of select companies that are exposed to greater size and value factor risk in aggregate compared to the Morningstar Emerging Markets Index, an index weighted by the market capitalization of companies registered in emerging markets.

- Vanguard FTSE Europe ETF $VGK- The investment seeks to track the performance of a benchmark index that measures the return on investments in stocks issued by companies domiciled in the major markets of Europe. The fund uses an indexing investment approach by investing all or substantially all of its assets in common stocks included in the FTSE Developed Europe All Cap Index.

Equities with Ukrainian exposure

Many domestic companies have exposure to Ukraine based on where they do business. Many other companies have business relationships that have been affected by the escalating situation in Ukraine.

Expedia Group $EXPE- A travel company that understandably saw a drop in earnings when the invasion of Ukraine began due to the obvious travel concerns the conflict has caused. The travel sector has taken quite a few hits, whether related to the pandemic or even now the conflict in Ukraine.

Yahoo Source. Finance

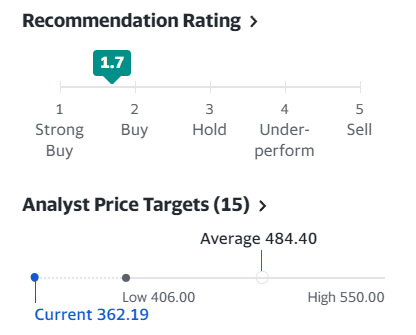

Epam Systems $EPAM - Digital engineering and software platforms currently employ 14,000 workers in Ukraine. Stock prices have naturally fallen since the invasion began, but some analysts see this as a good buying opportunity. Management continues to address the high exposure to Ukraine and Russia. The company was even able to report a very strong start to 2022 with a 50% increase in revenue.

Yahoo Source. Finance

Carnival $CCL- This is the world's largest cruise ship operator and generates approximately 3.6% of its revenue from Russia and Ukraine. Shares of this stock have fallen since the invasion began due to rising fuel prices and revenue losses. In March 2022, the company announced a $3 million Ukraine relief deal. It's worth paying attention to this company as it tries to navigate a challenging environment with everything going on in Ukraine.

Yahoo Source. Finance

Ukrainian stock market

PFT is the Ukrainian stock market. Following are some of the biggest Ukrainian companies you can invest in globally. When considering potential investments, be aware that there is currently a high risk associated with trading in global markets due to local uncertainty and volatility associated with the war.

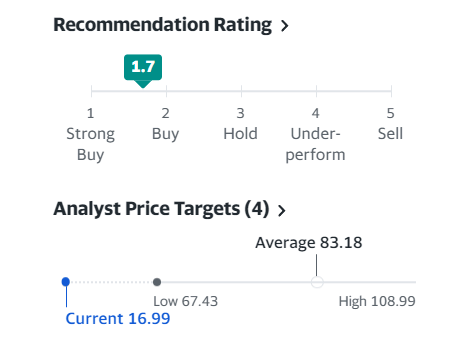

Kernel Holding SA KER.WA

Kernel Holding is the largest producer of sunflower oil in Ukraine, based in Kiev. The company trades on the Warsaw Stock Exchange. Kernel Holding has seven different business segments in the agricultural sector. The company suffered major setbacks regarding planting and exports as a result of the Russian invasion.

Source: Yahoo.Finance

As we can see analysts from Yahoo give this company a BUY status and average price estimate as high as $83, which at the current price of $17, is almost a 500% increase.

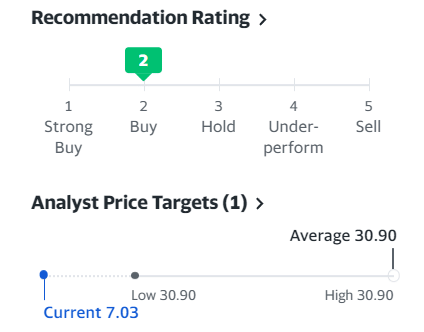

UkrTelecom UTLM

Ukrtelecom is a Ukrainian telecommunications provider with a portfolio of five different business sectors: mobile services, enterprise, consumer, corporate clients and operators and providers. Founded in 1991 in Kiev, the company has been instrumental in news delivery and communications since the beginning of the war in Ukraine.

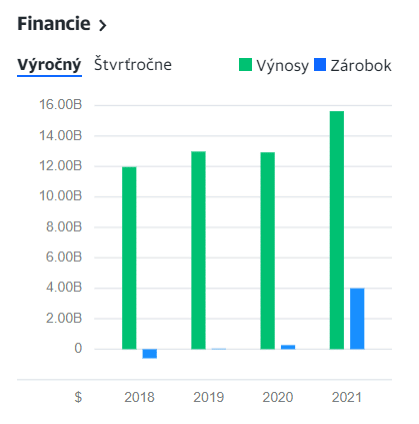

Astarta Holdings AST.WA

Ukrainian agricultural and industrial holding company currently listed on the Warsaw Stock Exchange. As major ports have been closed due to the ongoing war, Astarta reported that at one point more than 150,000 tons of grain was stranded at the border. The company had agreed to ship 25,000 metric tons of corn to European partners in April, but faced permitting problems from railroad officials.

Yahoo Source. Finance

We can see that the financials had a pretty strong year in 2021.

Source: Yahoo.Finance

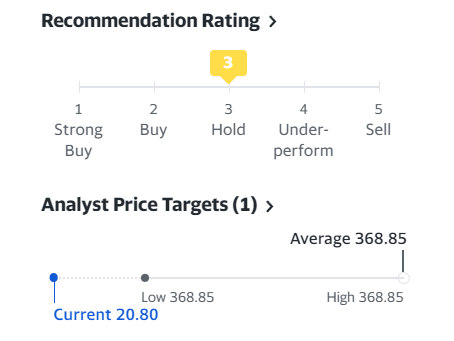

As for the rating of this company, we can see a Hold status, which may also be due to the constant uncertainty of the Ukrainian market. And the price per share is significantly undervalued according to the analysis on Yahoo.

As you already know, the war in Ukraine has caused volatility in the global stock market. Sometimes volatility can create new opportunities. Other times, volatility can lead to short-term mistakes due to panic. Many factors are worth considering before investing in Ukrainian securities or stocks that could be affected by the ongoing conflict between Russia and Ukraine. Hopefully, many businesses can resume operations in Ukraine when they feel it is safe to do so. When you want to invest in the Ukrainian market, you must also consider the sanctions that are imposed on Russia. As a result of the Russian invasion, many countries around the world have limited trade relations with them. This also affects Ukraine, as the closure of ports has led to delays and trade problems. All these supply chain problems have contributed to a global increase in inflation.