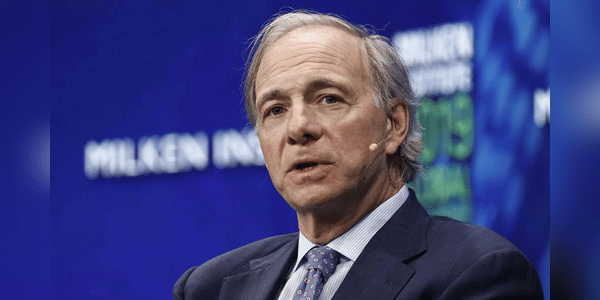

Legendary investor Ray Dalio probably needs no introduction, his track record and reputation as an investor simply speaks for itself. Dalio is one of those investors who likes to comment on market events and the future outlook. Today, we'll take a look at his latest comments where he talks about a possible 20% drop and the Fed's actions.

Ray Dalio - one of two investment directors at Bridgewater Associates, the world's largest hedge fund.

Why is Dalio expecting another 20% drop in stocks?

"We're starting to see all the classic early signals": Legendary investor Ray Dalio says the stock market must fall further before a recession hits. He estimates that raising rates from where they are to about 4.5% will have about a 20% negative impact on stock prices.

For most of this year, the Fed has held steadfast to its "soft landing" goal for inflation, the idea of beating inflation without a dramatic economic downturn.

- However, this has so far proven to be a less likely option, as has the statement…