Get rid of these stocks before it's too late, says a world-famous billionaire manager. He pointed to specific names

It is interesting to follow the purchases and recommendations of investors. But it's even more interesting to follow their sales and warnings about stocks that they think could currently hurt your portfolio. The legendary Dan Loeb has pointed to several of these!

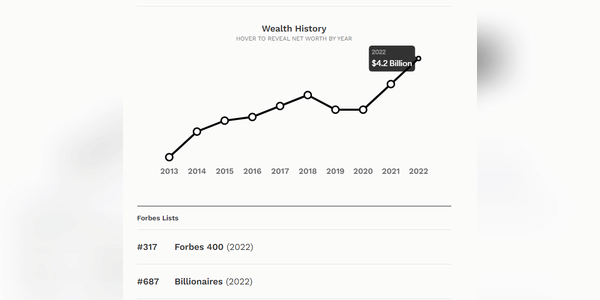

Daniel Loeb is the CEO and Chief Investment Officer of Third Point LLC, a hedge fund founded in 1995. With an estimated net worth of $4.2 billion and three decades of investment experience under his belt, Dan Loeb is known for launching activist campaigns against corporate boards in various industries and countries. Such a militant version of Icahn 😁

His experience is varied - even if we leave out his own hedge fund. In fact, he has served on the boards of five publicly traded companies: Ligand Pharmaceuticals, POGO Producing Co, Massey Energy, Yahoo! and Sotheby's.

very nice information

Eliminating the stock market would likely reduce income inequality between those who can invest to grow their wealth and those who cannot. A country without a stock market might have more even income levels between classes but an overall weaker economy with fewer major corporations.

Please!! note that this is not financial advice Every investment must go through a thorough analysis

nice information

great

This Good Information, Thank's!!!

I Like Your Post.

I Like Your Post.

I Like Your Post.

I Like Your Post.

I Like Your Post.I Like Your Post.

He also mentioned that he is preparing for a recession,