The global electric vehicle market share has seen a huge shift forward in the last decade and this trend is expected to accelerate exponentially in the future. It is the growth of electric vehicles that is driving the demand for next-generation power semiconductors, especially those made from silicon carbide. Here is a list of the companies that will benefit most from this trend in the coming years.

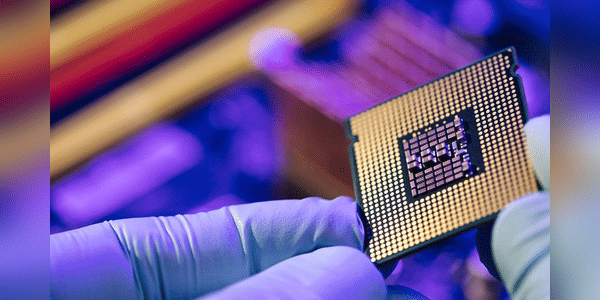

Silicon carbide semiconductors can operate at much higher voltages, temperatures and frequencies than traditional silicon-based semiconductors. This makes them a better choice for electric vehicles, solar power conversion, 5G wireless networks, aerospace and other applications. In addition, the largest initial market for silicon carbide (SiC) chips is electric vehicles. Silicon carbide chips provide faster charging and longer range for electric vehicles.

Investment bank Canaccord Genuity estimates that…

Please!! note that this is not financial advice Every investment must go through a thorough analysis

great

This Good Information, Thank's!!!