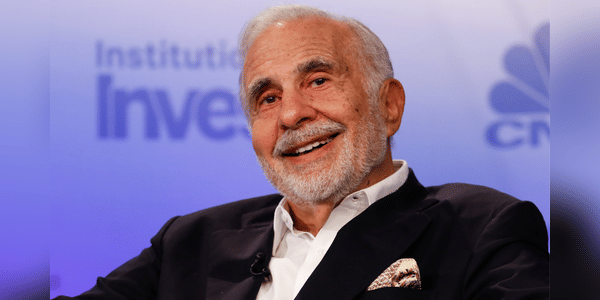

With less than two and a half months to go until the end of the year, it is already obvious that this will be one of the toughest years on record for investors. The broad S&P 500 index has posted its worst first-half return since Richard Nixon was president. Here are 2 stocks that investment legend Carl Icahn is currently betting on.

Yet, while many investors suffered painful losses in 2022 - the S&P 500 had its worst first half since 1970 - Icahn is not one of them. At his company, Icahn Enterprises, net asset value is up about 30% in the first six months of this year.

Looking ahead, his outlook is not optimistic. "The worst is yet to come," Icahn says, warning that "inflation is a terrible thing" and "you can't just get rid of it."

Carl Icahn's investment strategy

Like fellow billionaire Warren Buffett, Icahn subscribes to a value investing strategy. In general, Icahn is interested in investing in stocks that do not…

Please!! note that this is not financial advice Every investment must go through a thorough analysis....

great

This Good Information, Thank's!!!