Tesla - a company that polarizes the investment world. Some love it unconditionally and praise it to the skies. Others hate it because they see its price as exorbitant. Let's take a look at the numbers that might put this right!

In the race for electric cars, every detail matters because it can make the difference. And it's often the details that can give some players a distinct psychological advantage or undermine the morale of others.

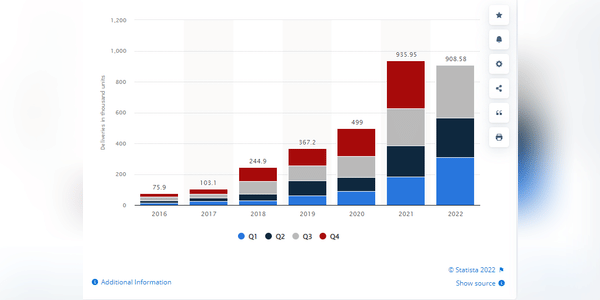

For Tesla $TSLA, the current market leader, the task is clear - to maintain its lead and increase it so that only crumbs remain for rivals who have come too late to the game. What can we say - Tesla's lead is huge. Especially in infrastructure, expansion, etc. But that's not enough for the company. It's stepping on the gas (electricity? 😛) as much as it can. The Austin, Texas-based automaker has set a goal of delivering at least 1.5 million cars in 2022 , which will be an all-time high.

very nice information

like it

Thanks!

i like a car bro men

BTC IS KING

great

This Good Information, Thank's!!!