Warren Buffett is not considered the best investor of all time for nothing. He has shown his qualities over the long term, repeatedly and consistently. And he has done it again now. His favorite company excelled while the rest of the market bled.

The performance of most companies so far has been more in line with the general mood and state of the market. There are exceptions, but not many. It is all the more surprising when some of the huge names shine like this. Conversely, it's not such a surprise that it's a title that the Oracle of Omaha himself is banking on.

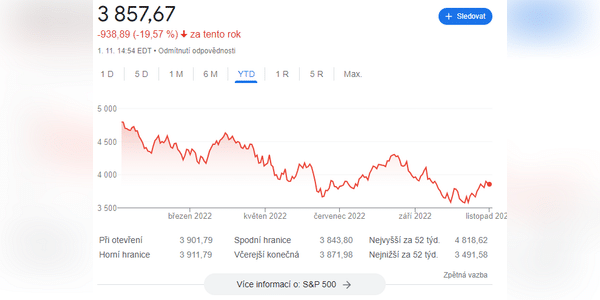

Apple $AAPL, with a total holding of about $133 billion, makes up about 40% of Warren Buffett's stock portfolio. That's why how Apple's products fare in each year is just as important to Berkshire Hathaway $BRK-B shareholders as it is to Apple shareholders. Other Big Techs have rather disappointed in Q3 2022, but Apple…

Awesome

a

???

Nice Content

bitcoin is great product these days.. i luv this one.

good

Thanks!

Thanks!

Thanks!

Hubo un tiempo hace años en que las únicas personas que podían comerciar activamente en el mercado de valores eran las que trabajaban para grandes instituciones financieras, casas de bolsa y casas comerciales. La llegada del comercio en línea, junto con la difusión instantánea de noticias, ha nivelado el campo de juego, o deberíamos decir comercio. Las aplicaciones comerciales fáciles de usar y el 0% de comisiones de servicios como Robinhood, TD Ameritrade y Charles Schwab han hecho que sea más fácil que nunca para los inversores minoristas intentar operar como los profesionales.