These 2 stocks from Warren Buffett's portfolio could rise 129% and 140% in the next 12 months, according to analysts

As of last week, Warren Buffett held nearly forty stocks in his investment portfolio through Berkshire Hathaway. Two of those titles have been given high price targets by Wall Street, suggesting they could rise 129% and 140% over the next 12 months.

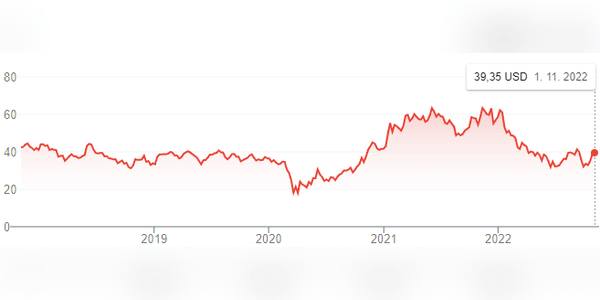

General Motors $GM: Implied up 129%

If there's a Wall Street price target for Warren Buffett's stock that has to impress investors, it's the $90 price target that analyst John Murphy of Bank of America Securities has set for automaker General Motors. If that price target is met, GM shareholders would enjoy a 157% gain from where the company's stock ended Wednesday, Nov. 2.

This ambitious target reflects two key aspects of the company - its financial growth potential and electric vehicle (EV) strategy. When investors hear about companies that have doubled their top-line earnings, most would think of smaller, younger companies - not the massive, historic General Motors, which has seen countless…

fsdgshdf

Thanks!

great

This Good Information, Thank's!!!

The bank plans to exit its correspondent banking business that sells mortgages through third-party customers and significantly shrink its mortgage servicing portfolio through asset sales. The bank also announced it will invest $100 million to advance racial equity in homeownership, including strategic partnerships with non-profit organizations.

Good Information

CFP National Championship 2023 Live: The TCU Horned Frogs will try to dethrone the No. 1-ranked Georgia Bulldogs in the 2023 College Football Playoff National Championship Game at SoFi Stadium on Monday night.

🆆🅰🆃🅲🅷🔴▶️ https://livevstream.org/cfpfinal

College Football Playoff National Championship info

Date: January 9, 2023Kick-off time: 8:00 p.m. ETTV channel: ESPN

In Texas, sports betting isn’t legal but that doesn’t mean residents have to miss out on the biggest college football game of the year. The top online sportsbooks are welcoming residents from Texas with free bets and up to $2,750 in free bonus cash for Georgia vs TCU.

As 13.5-point underdogs, the Horned Frogs own +395 odds to win the 2023 National Championship, giving football fans plenty of incentive to get in on the action.

How To Bet On The 2023 National Championship Game In Texas

The TCU Horned Frogs have a chance to win their first national title since 1938.

Even though sports betting in Texas isn’t regulated, college football fans don’t have to drive out of state to bet on the 2023 CFP National Championship.

Instead, college football fans in Texas can get in on the action with the top offshore betting sites.

In just four easy steps, new members can sign up and receive up to $2,750 in free bonus cash, plus two free bets for Georgia vs TCU.

CFP National Championship Game 2023 Odds

Following an exciting start to the College Football Playoffs, Georgia and TCU will meet in the 2023 National Championship Game on Monday night.

After an exciting 42-41 comeback win in the semifinal versus Ohio State, Kirby Smart has Georgia on the brink of another national title. The Bulldogs are trying to become the first back-to-back national champions since 2012 and will be favored to win by 13.5 points against a seemingly overmatched TCU team.

On the other hand, the Horned Frogs stunned No. 2-ranked Michigan to win the Fiesta Bowl to make their first national championship appearance since 1938. Projected to lose by nearly two touchdowns, TCU will be a +395 underdog to win the 2023 CFP National Championship Game.

For a complete breakdown of the 2023 College Football Playoff National Championship odds, check out the betting lines for Georgia vs TCU from BetOnline below.

Slumps are a natural part of the market. But we are all probably eagerly awaiting the end of this year's. And in the flood of pessimistic views comes an analyst from Morgan Stanley who believes the end of the bearmarket is coming soon! When?

With US stocks down more than 20% this year, investors are looking for good news. And that's exactly what an analyst from Morgan Stanley has come up with. What does he say?

Second, performance will be slowed by the maturation of Alphabet's core search advertising business. Certainly, growth in other segments, such as cloud computing, could outweigh this.

However, a third factor (increasing competition) may spoil the chances of that happening. High competition for market share between Alphabet and rivals like Amazon and Microsoft may limit future growth and swing to profitability of its cloud business.

Amazon Web Services (AWS), a profitable cloud platform online retailer that has established itself as the early leader in the cloud infrastructure market, is still ahead. Synergy Research Group estimates that Amazon's market share of the global cloud infrastructure market will reach 34 percent in the third quarter of 2022, still exceeding the combined market share of its two largest competitors, Microsoft Azure and Google Cloud.

https://bulnewstime.com/

https://tamilankanews.com/

https://dailyromanews.com/

https://ballsource.eu.org/

https://filmecueros.com/

https://mercutimes.com/

https://www.bultimes.eu.org/

https://sorabie.com/

https://mencret.site/

In an interview with Bloomberg Television, Mike Wilson, the firm's equity strategist and chief investment officer, predicted that the bear market in U.S. stocks could end by early 2023. Investors are taking this seriously because Wilson, who is usually extremely skeptical of the market, recently won a prestigious award for best institutional investor.

Big tech" stocks have lagged the broad S&P 500 index this year, and online advertising giant Alphabet is no exception. Its stock is down nearly 34% year-to-date compared to the S&P 500, which has erased about 16%. Here are 3 reasons why this underperformance in GOOG stock could persist into 2023.

On closer inspection, however, the question is whether improving economic conditions will mean a big rebound for the tech giant's stock. The road back to its all-time high closing price ($150.71 per share ) could be much longer than currently expected.

There are three factors, all of which will remain in play even after today's problems, such as inflation and slowing economic growth, are resolved. With that in mind, the stock (just under $100 per share today) may not be the opportunity to miss that some think it is.

First, interest rates, which are undoubtedly related to the company's current headwinds. Inflation is at its highest level in decades. But the Federal Reserve, which sets the country's monetary policy, took another step at its last meeting in its attempt to curb these economic stresses by raising interest rates by three-quarters of a percentage point for the fourth time this year. "Without price stability, the economy doesn't work for anybody," Fed Chairman Jerome Powell said at a news conference on Wednesday, Nov. 2.

High inflation has led to high interest rates, which has affected economic growth and Alphabet's underlying performance. Still, even after inflation cools, interest rates won't necessarily return to near zero. That could limit the extent to which GOOG's earnings multiple (currently at 18.94 ) will expand again after the downturn. Investors are therefore now wondering whether, after a cycle of interest rate hikes around the world, markets are approaching a so-called pivot, i.e. a slowdown in the pace of such rapid tightening and a reversal in central bankers' rhetoric. Today, it's the Fed's turn again. US consumer price inflation has boosted the chances of a dovish move by the Fed. A rate hike at today's meeting is more than certain. The market is currently discounting a 50 basis point rate hike at tomorrow's FOMC meeting. Also of note will be the release of the dot-plot (published quarterly) in which members communicate their current expectations for interest rates.