These 2 stocks should be on your radar according to analysts

2022 was not a good year for investors. But there is one very positive thing about it. That is the situation where there were super investment opportunities on the markets that investors could take advantage of and make a lot of money from in the future. If you missed out last year, don't despair. Today, we're going to take a look at 2 stocks that analysts say you should be on the lookout for.

How to spot great investment opportunities for the future. In short, just look at what traits companies that are successful today have exhibited in the past. These traits may be strong fundamentals supported by above-average revenue and earnings growth, for example, or they may show trends in fund ownership, or they may simply thrive in declining markets. Today, we look at two companies that are not in many investors' sights at the moment, but analysts believe they are quality investments.

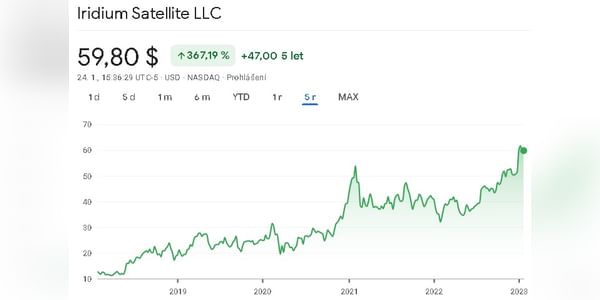

Iridium Communications $IRDM

The first of these two companies…