Investors, experts and political leaders alike agree that a recession is coming. In their view, it is not a question of if, but when and how. And the world's largest asset manager, BlackRock, has some worrying news.

Many experts are already sounding the alarm when it comes to the US economy. But BlackRock - the world's largest asset manager - has an even more radical warning. It is predicting an unprecedented recession.

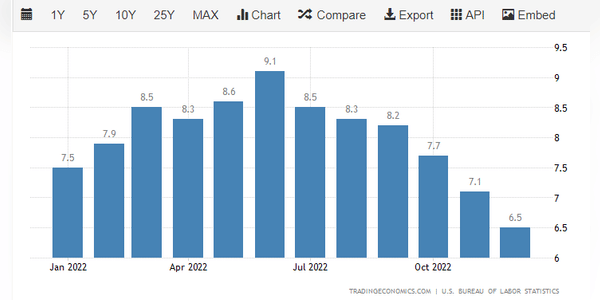

"A recession is highly likely as central banks race to tame inflation," BlackRock 's team of strategists write in their global outlook for 2023. In fact, they believe that central banks are deliberately causing a recession by tightening policy too much in an attempt to bring the price level under control.

In the past, when the economy went into a downturn, the Fed usually stepped in to help. But given the cause of this supposed recession, we can…