These are 2 stocks that even George Soros himself trusts. Are they ideal to buy now?

A lot of people are not very confident about their decisions in the markets. Therefore, there is nothing easier than to have your decision confirmed by someone who has been in the markets for a long time, based on careful analysis. So today we'll look at 2 stocks that even George Soros himself trusts.

If you're looking for someone to draw inspiration from, or where you can confirm your investment decisions, George Soros is a good choice. Of course, you can't just mindlessly copy Soros' portfolio positions, but you also have to take into account that stock prices move, and just when you want to get in, Soros may already be in for a very decent profit.

Who is George Soros?

Why might he be the person to lean on here? So let's briefly introduce George Soros. This is the man who founded, and more importantly runs, one of the most successful funds called the Quantum Fund. This fund has provided investors with annual compound returns of around 20% for many decades. In short, this is a brilliant investor.

Soros was also known as the man who broke the Bank of England, when he helped to force the UK Government out of the European Exchange Rate Mechanism with his short positions of USD 10 billion. During the 1992 UK currency crisis during Black Wednesday, Soros made $1 billion. Not a decent one day, is it?

Now we know the reason why George Soros is the man to take inspiration from. So let's take a look at 2 stocks from his portfolio that Soros trusts and that might be interesting to watch at the very least.

DR Horton $DHI

DR Horton, Inc. $DHI is a Delaware-incorporated homebuilding company based in Arlington, Texas. Since 2002, the company has been the largest homebuilder by volume in the United States. The company ranked 194th on the 2019 Fortune 500 list of America's largest corporations by revenue. The company operates in 29 states.

DR Horton operates four brands: Emerald Homes, Express Homes, and Freedom Homes.

- Express Homes - Here we are all about homes for ordinary people like us. In short, simple, plain homes. Nothing luxurious or fancy.

- Emerald Homes - Under this brand, the company builds luxury homes for wealthy clients.

- Freedom Homes- The company's semi-famous brand simply cares about communities, and building community housing.

So let's take a quick look at the longer term results. Revenues over the last 5 years have grown by an average of about 22%. Net income over the last 5 years has then grown by an average of about 60%. For me personally, these are very impressive numbers. I just don't see a company with this type of business showing such long term growth. The enormous growth in net profit also points to very strong net margins.

And how has the company done over the last year? The company reported revenues of $33.48 billion, up roughly 20% year-over-year. The company's net profit for 2022 was $5.86 billion, up a whopping 40% year-over-year. As we can see here, the company's results have been on a steady upward trajectory since 2018. I find it almost unbelievable what kind of results the company has achieved in 2022, a year of high inflation and high interest rates. Paradoxically, I would not have expected such good results from this type of company in such times. Interest rates are freezing demand for credit, and high inflation is driving up the price of building materials.

The company continues to have a very strong balance sheet that shows tremendous financial stability. The company is able to cover all its liabilities with its current assets. Just to give you an idea, some technology companies have such a strong balance sheet. You can imagine it on yourself, for example. You have a mortgage on your house, a car loan, and maybe some smaller loans. And you have so much money in your account that you're able to pay all these loans and the mortgage immediately. In terms of the value of assets net of liabilities, that comes out to about $56 per share here.

In terms of operating cash flow, that's growing at an average of about 50% a year until 2020. 2021 and 2022 erased that growth, and the company reported about the same operating cashflow for those years as it did 5 years ago. Further, on the positive side, while operating cashflow is not growing at a breakneck pace, the company has been able to reduce capital expenditures in the last year. As a result, however, the same situation also occurs in the case of free cash flow. The company's free cash flow grew at a decent pace until 2020, and in 2021 and 2022, free cash flow fell back to levels somewhere around five years ago.

This company was recently researched by 14 analysts. Of those, 9 analysts agree that there is a good buying opportunity here. The average price target of these analysts is $108.

For me personally, this is a very decent company, and a hot buy candidate. Personally, though, I am concerned that the current price is not very favorable. However, I am definitely putting this company on my watchlist and will continue to follow it. The only thing that bothers me about the company is the drop in cashflow over the last 2 years. Here, I recommend to examine the statements, and find out what caused this decline.

TransDigm Group $TDG

Here we have another selection from Soros' portfolio. This time it is a company involved in the manufacture and supply of aerospace parts. The company acquired many of its products through acquisitions of competitors. TransDigm's subsidiaries manufacture aircraft components. These components include items such as pumps, valves and avionics. Most of the aerospace parts sold by the Company are proprietary products, and TransDigm is the only manufacturer currently producing these parts. As of 2016, approximately half of their revenue comes from aftermarket parts and half from OEM parts. Since 2008, about three-quarters of its revenue has been from commercial aircraft parts and one-quarter from military aircraft parts.

TransDigm's products fall into three segments.

- Power and Control Products - This includes products such as pumps, valves and ignition systems. This segment accounts for about half of the company's revenue.

- Aircraft interior products - This includes cockpit equipment products such as latching and locking devices, cockpit safety components and audio systems. This segment accounts for most of the other half of TransDigm's revenue.

- Non-Aerospace Products - The smallest portion of the company's business is non-aerospace products such as barriers, space systems and parts for heavy industrial equipment.

Let's now take a quick look at the company's numbers. The company's sales have grown at an average annual rate of about 9% over the past 5 years. In terms of net profit, it has been more or less flat. This situation means a decline in the company's net margins, which were actually declining until 2020. Now, in the last 2 years, net margins have started to rise again. But despite the decline in margins, the company has been reporting net margins of around 10% at the deepest point.

In the short term, the company is doing well because it is showing some financial strength. Over the last 5 years, the company has had enough current assets to be able to pay all its short-term liabilities. Longer term, the company appears to me to be somewhat overleveraged as it has more long-term debt than total assets. So here we need to dig into the balance sheet and look at the distribution of that debt. Unfortunately, the value of net assets cannot be determined here because the company's liabilities are higher than its assets.

The company's operating cash flow has been stagnant for the last 5 years. Along with the stagnant operating cash flow, the company has been able to keep its capital expenditures flat. As a result, free cash flow is also stagnant, which may not be good for the company, especially when cash flow is stagnant over the long term. On the other hand, the company has relatively predictable free cash flow as a result.

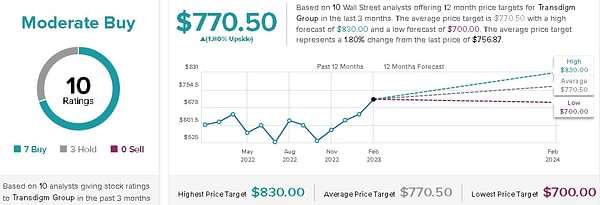

Recently, a total of 10 analysts have looked at the company, of which 7 analysts agreed that this is a buying opportunity. The average price target for this year is roughly $770.

Personally, I can understand such a low analyst valuation. I see 2 major problems with this company. The first problem is the relatively high debt, and the second problem is the stagnant cash flow. At the same time, I also see a growth opportunity for the company here, along with the aerospace development sector. For me personally, the company seems a bit overpriced at the moment, but I will definitely keep an eye on this company as well.

DISCLAIMER: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.

Sources:

https://www.marketwatch.com/investing/stock/tdg?mod=mw_quote_tab

https://www.marketwatch.com/investing/stock/dhi?mod=search_symbol