Inflation has 75% chance of bouncing higher or staying high, warns top economist

Mohamed El-Erian, the world's leading economist, warns that the problem of inflation (in the US economy) is far from over. Although inflation is finally starting to come down, El-Erian says there is still a 75% chance that it will rise sharply again this year or remain unusually high.

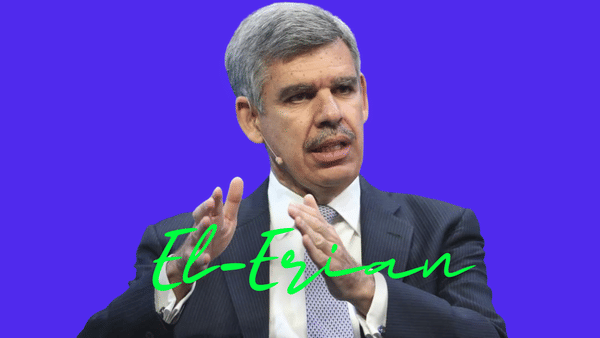

Who is Mohamed El-Erian?

Mohamed El-Erian is a world-renowned economist and investor. But he was also previously a director of the investment firm PIMCO and has also worked at the International Monetary Fund.

What is El-Erian coming up with this time?

In one of his interviews, he said that inflation is finally starting to come down, but in his view it would be "dangerous" to assume that the worst is over.

The new year began with a wave of optimism that the painful chapter of high inflation in the U.S. was finally ending after the Labor Department reported that the Consumer Price Index fell 0.1% in December and rose only 6.5% from a year earlier, the slowest pace since 2021.

El-Erian argues that this optimism is unfounded. He sees an equal chance that inflation will either continue to fall or that consumer goods prices will reverse and rise sharply again. The most likely scenario is that inflation stabilizes around 3% or 4%, which would force the Fed to choose between dampening the economy to get inflation to the targeted 2%, adjusting the target interest rate to be consistent with changing supply conditions, or wait and see if the U.S. can live with stable inflation of 3-4%.

"I don't know what the Fed would choose in that case, but I estimate the probability of such inflation at 50%," he said. Although U.S. inflation has fallen from a peak of 9.1% in June, underlying price pressures are still evident in the economy.

Core inflation, which excludes more volatile measures of food and energy, remains relentlessly high. Meanwhile, the Bureau of Labor Statistics reported that the economy added 517,000 jobs in January - nearly triple Wall Street's expectations. All this is happening despite the Federal Reserve's most aggressive campaign to raise interest rates since 1980.

How do Fed officials see it so far?

Fed Chairman Jerome Powell touted the slow and steady decline in inflation, but suggested during the Q&A that the central bank has more work to do in the fight to tame consumer prices.

Markets expect the Fed to raise rates at least two more times this year, which was confirmed by statements from some of its officials.

Michelle Bowman (Fed Governor) and Thomas Barkin (President of the Richmond Fed) are in favor of at least 2 more 25bps rate hikes, while the likes of Federal Reserve Bank of Cleveland President Loretta Mester said she sees compelling reasons to implement another 50bps rate hike.

- How do you see it? 🤔

Please note that this is not financial advice. Every investment must undergo a thorough analysis.