Today's era is increasingly moving to a digital environment. Recently, analysts at Goldman Sachs revealed 2 stocks that could help long-term investors benefit from this gradual transformation. Let's briefly introduce them.

With most things, data and processes moving into the digital space, it has never been more important to address the security of that data than it is today. And with increasing digitization, this trend will only grow. And this is where Goldman Sachs analysts see the potential for very good value for long-term investors. Specifically, they agree on these two names that should dominate the sector in the future.

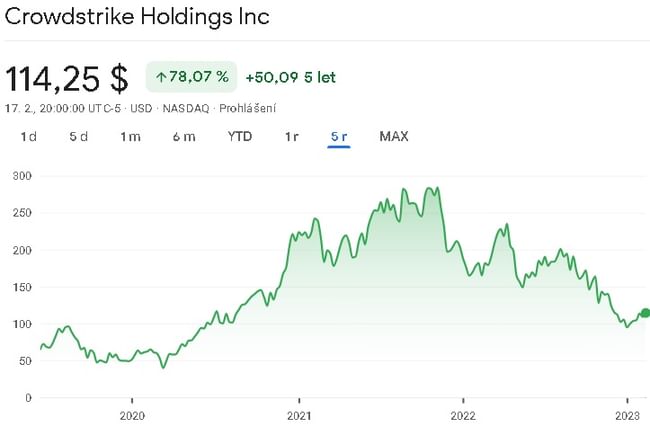

CrowdStrike Holdings $CRWD

CrowdStrike Holdings is a cybersecurity company that provides endpoint protection, threat intelligence, and incident response services to its customers. The company is one of the leaders in the endpoint security market, and its cloud platform is gaining market share. The company is growing its customer base, which reached more than 12,500 customers in fiscal 2021. CrowdStrike is also expanding its international presence, with its international sales growing faster than its domestic sales.

CrowdStrike's cloud platform has several advantages over traditional on-premise security solutions. The platform allows the company to respond quickly to new threats and provide real-time protection to its customers. The company's threat intelligence capabilities are also a key difference, as it uses machine learning and other advanced technologies to detect and prevent sophisticated cyberattacks.

The company's revenue has grown at an average annual rate of about 87% over the past five years. The company is not profitable at this time, so we will break away from gross profit, which has grown at an average of about 100% per year over the past 5 years. The company has been experiencing increasing gross margins, with gross margins recently around 73%. The company has rapidly increasing research and development costs, which has the effect of making the company unprofitable. In short, it invests all the money earned back into research and development of new products.

The company reported some reliable metrics in its latest quarterly report for Q3 of fiscal 2023. Revenue grew 53% year-over-year to $581 million and annual recurring revenue of $2.34 billion grew 54%. Bottom line, CrowdStrike reported fiscal Q3 earnings of 40 cents per share by non-GAAP measures, beating the consensus estimate of 32 cents per share.

As for the balance sheet, it looks relatively stable. The company has enough current assets to cover all of its liabilities. As a result, it should not have significant problems paying its liabilities. The debt-to-equity ratio here is at 0.74. The value of assets net of liabilities here works out to me at about USD 4 per share.

Goldman Sachs analyst Gabriela Borges acknowledges that current market conditions are a headwind for the stock, but believes the company is well positioned for strong growth.

We expect to see a moderation in the pace of growth, driven primarily by slower endpoint growth and a slower pace of market share gain. At the same time, we believe the market understands this well. Over the medium term, we expect steady growth in the endpoint segment (80%+ ARR), based on our market share model, which suggests that next-generation endpoint technology now holds close to 50% share. We also expect tremendous growth in the cloud, where our industry conversations suggest CrowdStrike is competitive given its core competencies in data collection and monitoring. We believe the risk-reward ratio here is attractive.

A total of 37 analysts have recently looked at this company, with 32 finding the stock a good buy. These 37 analysts agreed on an average target price of $160 per share.

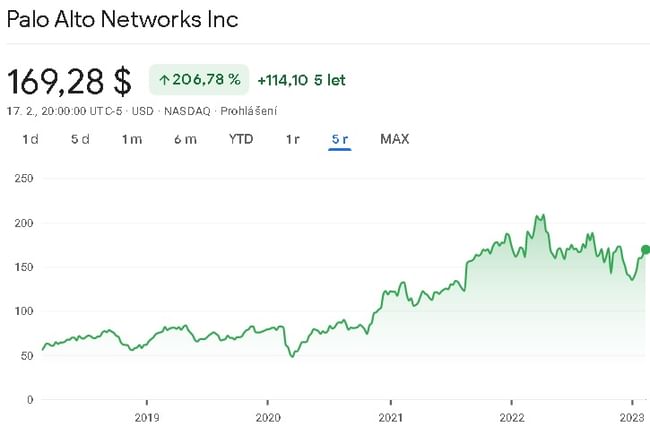

Palo Alto Networks $PANW

Palo Alto Networks is a cybersecurity company that specializes in providing advanced security solutions to protect organizations from cyber threats. The company offers a range of products and services, including firewalls, endpoint protection, cloud security, threat intelligence, and security analytics.

One of Palo Alto Networks' key strengths is its next-generation firewall technology, which uses a combination of application identification, user identification and content inspection to provide granular control over network traffic. This approach enables organizations to enforce policies that are tailored to their specific needs and protect against a wide range of threats, including malware, phishing and data exfiltration.

In addition to its firewall technology, Palo Alto Networks has also invested significantly in cloud security, recognizing the growing importance of cloud infrastructure in today's business environment. The company's cloud security solutions include Prisma Cloud, which provides visibility and control over cloud workloads and services, and VM-Series, a virtualized firewall that can be deployed in public and private cloud environments.

Another area Palo Alto Networks is investing in is security analytics, recognizing the importance of rapid threat detection and response. The company's Cortex XDR security analytics platform uses artificial intelligence and machine learning to analyze network and endpoint data, identify suspicious activity and provide automated response capabilities.

Overall, Palo Alto Networks is a respected player in the cybersecurity industry with a strong focus on innovation and customer satisfaction. The company's solutions are used by organizations of all sizes and across a wide range of industries, including healthcare, financial services and government.

The company's revenue has grown at an average annual rate of approximately 28% over the past 5 years. Again, the company is not profitable, so we look at gross profit, which has grown at an average of about 26% over the last 5 years. Since 2020, the company's gross margins have declined, but they are still around 70%. Here too, the same situation exists, with all profits at the moment being swallowed up by the costs of research and development of new products, and the costs incurred to grow the company.

From a balance sheet perspective, the company looks relatively financially stable, but its short-term liabilities have risen more recently. This was due to the maturity of most of the long-term debt. Otherwise, at the moment the company has virtually minimal debt, so it should not run into problems in the future. While the company's debt has fallen, so has the company's equity, which at the moment is about the same size as the long-term debt.

What is certainly positive news, however, is that over the past 5 years the company has generated positive free cash flow, which has grown at an average rate of about 19% per year. Operating cash flow has also grown on average by roughly that 19% per year since then. The company has been able to keep its capital expenditures relatively at bay.

Goldman Sachs analyst Gabriela Borges is clear here, and she has full confidence in the company.

We consider Palo Alto to have a portfolio of networking, endpoint and cloud products at various stages of product maturity, each leveraging the expertise of a centralized domain. In user interface/user experience (UIUX), marketing, security intelligence and machine learning. Together with a successful M&A strategy, we expect sustained growth of approximately 20% over the next 5 years with top quartile software KPIs, a path to GAAP profitability this year, and active capital allocation.

A total of 29 analysts have recently looked at the company, and 27 of them are bullish on the company. These analysts have a consensus average target price of $211 per share.

Conclusion

For me personally, I'm not entirely sure the company is a good choice at the current time. For one thing, it is loss-making at the moment, and it has only started to show free cash flow in the last 2 years, and not a particularly large one at that. Certainly if the company somehow stabilizes, and starts bringing in more funds to investors, it will be a very promising investment. In short, there is a risk/reward ratio to consider here.

In the second case, I like the company a little more. It may not be profitable either, but it has been generating growing free cashflow for 5 years, which it can then use further. You could say that there is more indication that the company is already starting to slowly reap its rewards. If I had to pick one of these companies, I would pick Palo Alto Networks at this point. I'll definitely be keeping an eye on this company as I'm interested to see how it continues to evolve.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.