Pioneer Natural Resources: fat dividend, solid growth and well-targeted acquisitions

Although I've been meaning to leave the miners aside for a while, someone on Twitter tipped me off to an interesting dividend stock, which is Pioneer Natural Resources, which I'll look at in today's analysis.

Pioneer Natural Resources Co $PXD operates as an independent oil and gas exploration and production company. However, the company is also involved in hydrocarbon exploration in the Cline Shale region.

The company also operates refineries and distribution networks that supply oil and natural gas to customers around the world. In addition, Pioneer Natural Resources is involved in community projects and supports various environmental programs and initiatives.

- The company's primary focus is on operating projects in the Permian Basin, Eagle Ford Shale, Rockies and West Panhandle.

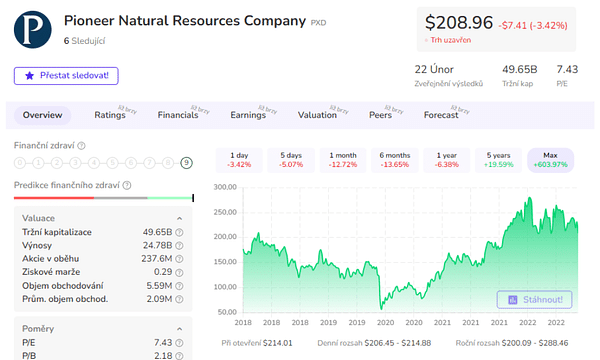

Founded in August 1997 and headquartered in Irving, Texas, Pioneer Natural Resources currently has a market capitalization of just under $50 billion.

What could be considered competitive advantages?

In the first place, I would say it would be quality oil and gas resources: the company has access to some of the largest and most productive oil and gas fields in the U.S., such as the Permian Basin in Texas and the Eagle Ford Shale in South Texas. These fields are well explored and have high concentrations of high quality oil and gas.

I would also say that they are technological innovations: Pioneer Natural Resources is distinguished by its research and development of new technologies that enable more efficient and sustainable oil and gas production. This includes, for example, the use of horizontal drilling techniques that make it possible to achieve greater oil and gas reserves at less cost.

Long-term contracts: Pioneer Natural Resources often seeks to enter into long-term contracts with customers, which allows it to secure predictable revenue and reduce its exposure to risk in the oil and gas market.

A look at the company's financial position

Revenues in recent years 👇

- Revenues in 2022 were $23.502 billion

- 2021 revenue was $14.643 billion

- Revenues for 2020 were $6.685 billion

- 2019 revenue was $9.325 billion

- On average over the last 5 years, revenues have grown by less than 50% per year

Net profit in recent years 👇

- Net profit in 2022 was $7.122 billion

- Net profit in 2021 was $2.113 billion

- Net profit for 2020 was USD -0.2 billion

- Net profit for 2019 was USD 0.77 billion

- Here we are talking about such 30% per year for the last 5 years

Assets 👇

- Total assets in 2022 were $35.746 billion, down 4.8% year-over-year.

- Total assets in 2021 were $36.811 billion, a 91.43% increase from 2020.

- Total assets for 2020 were $19.229 billion, an increase of 0.74% from 2019.

- Total assets for 2019 were $19.088 billion, an increase of 6.62% from 2018.

Liabilities 👇

- Total liabilities for the quarter ended September 30, 2022 were $12.797 billion, a decrease of 10.86% year-over-year.

- Total commitments for 2021 were $13.974 billion, an increase of 82.43% from 2020.

- Total liabilities for 2020 were $7.66 billion, an increase of 10.18% from 2019.

- Total liabilities for 2019 were $6.952 billion, an increase of 20.03% from 2018.

Long-term debt 👇

- Long-term debt for the quarter ended September 30, 2022 was $4.228 billion, a decrease of 36.75% year-over-year.

- Long-term debt for 2021 was $6.688 billion, an increase of 111.65% from 2020.

- Long-term debt for 2020 was $3.16 billion, an increase of 71.83% from 2019.

- Long-term debt for 2019 was $1.839 billion, a decrease of 19.48% from 2018.

The years 2019-2020, specifically the Company's results, were impacted by reduced oil demand combined with the completion of the Parsley Energy acquisition, which was a large financial burden. The company had to borrow a large amount of money for this acquisition, which led to an increase in its debt.

- Btw in 2021 the company also increased the number of shares outstanding, up almost 50%.

The P/E, P/S and P/B values are acceptable in my opinion, however they are a bit higher than the sector average.

However, the Debt/Eq - Debt to Equity ratio is very good here, which is at 0.23.

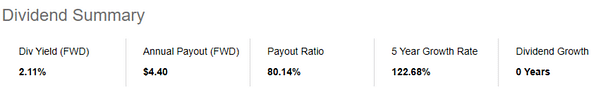

PXD gets a lot of attention mainly because of its fat dividend, but it is quite erratic. While the company has been paying dividends (intermittently) since 1997, it really is a roller coaster ride (intermittent payouts, fluctuations in the form of dividend increases and decreases) 👇

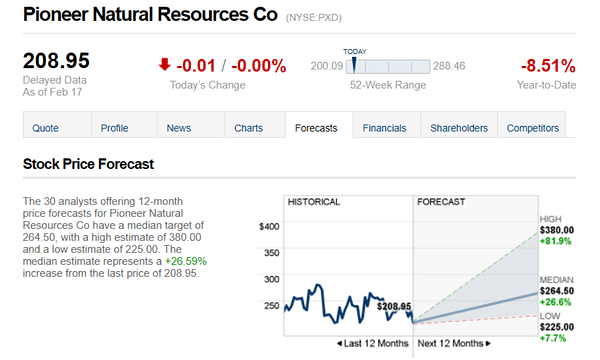

What are the prospects, and why do analysts see potential here?

In 2019, Pioneer Natural Resources announced its $7.6 billion acquisition of rival Parsley Energy, giving it access to new producing areas in the Permian Basin in Texas and New Mexico. This acquisition enabled the company to increase its production capacity and improve its market position.

The company is also investing in technology and innovation, which could help with higher production. In 2020, the company announced a partnership with Quantum Energy Partners to leverage hydrogen technology in the production and extraction of oil and gas. This collaboration could help reduce production costs and improve resource efficiency.

One more interesting and rather significant thing, the company benefited significantly from significantly low input prices for ''production-extraction'' of oil in 2022. I traced that a barrel cost them on average under $14, while the selling price went up to $94 per barrel.

Btw in 2 days the company is due to report us numbers for the quarter ending December, where analysts expect the company to achieve a year-on-year increase in profits on higher sales. But for investors, it will probably be more interesting to see what the company expects from 2023 onwards, as we will likely be provided with further outlook.

Conclusion

Analysts' expectations for growth are overly optimistic in my view, but this is not to discount the potential in terms of growth. Shares of $PXD are currently down -25% from the 2022 peak, which some find to be an interesting investment opportunity. However, I can't explain why expectations are so high at the moment. Personally, I'm not looking for more oil producers at the moment, so this piece certainly won't be visiting my portfolio anytime soon, but I've at least broadened my horizons to another interesting player and dissected one of the highlighted dividend picks among investors.

Please note that this is not financial advice. Every investment must go through a thorough analysis.