More and more voices are leaning towards the view that the recession will not arrive or will be really mild. In general, the mood in the market is positive. But central bank officials themselves are considerably more sceptical.

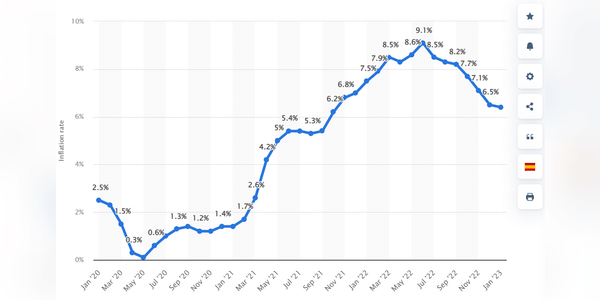

Two Federal Reserve officials suggested that inflation could persist longer than expected after the central bank's most closely watched inflation gauge rose the most in months.

Cleveland Fed President Loretta Mester and Fed Governor Philip Jefferson said they remain concerned about the inflation rate, which remains well above the Fed's 2 percent annual target.

Mester reiterated that while inflation has eased, the overall level remains too high. She pointed to recent Cleveland Fed research and a paper that suggested inflation could be more persistent than currently thought.

"I see the risks to the inflation forecast as skewed to the upside and the costs…