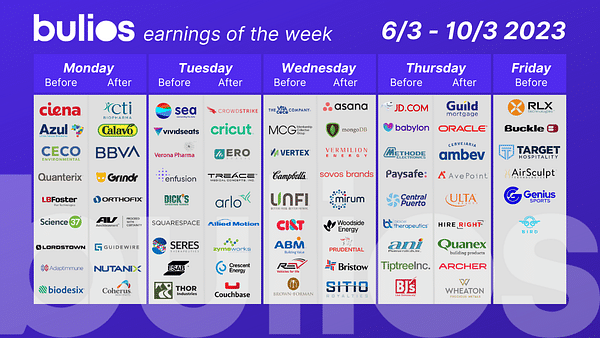

Crowdstrike, JD, Sea Ltd and others

The most interesting part of the results season is probably over. But that doesn't mean we won't find at least a few interesting companies reporting quarterly numbers next week. Let's take a look.

I personally don't have many favorites this week, but when I focus on the biggest or most well-known companies, I see JD, Sea, Crowdstrike, Oracle, Paysafe and Dicks, to name a few.

Let's take a look at what analysts are expecting 👇

Sea Ltd $SE+3.7%

Specifically, Wall Street expects the company to achieve revenue of $2.1 billion and net income of $550 million. These estimates are based on the strong growth in e-commerce, online gaming and digital payments that Sea Ltd has seen in recent quarters.

Crowdstrike $CRWD+1.4%

The company is expected to post quarterly earnings at $0.32 per share in its upcoming report, representing a year-over-year change of +88.2%.

Revenue is expected to be $574.65 million, up 51.2% from the previous quarter.

JD.com $JD-0.2%

JD.com, Inc. is expected to report earnings of $0.52 per share for the current quarter, representing a year-over-year change of +48.6%. For the current fiscal year, the consensus earnings estimate of $2.44 indicates a change of +44.4% from the prior year.

The revenue estimate for the current quarter of $43.18 billion indicates a year-over-year change of -0.3%.

Paysafe $PSFE+1.6%

PSFE's earnings estimate for the next quarter is $0.44, which would represent a quarter-over-quarter decline, while PSFE's revenue forecast for the next quarter is $375.41 million. This would suggest quarter-over-quarter growth.

Oracle $ORCL+0.6%

This software maker is expected to post quarterly earnings of $1.19 per share in its upcoming report, representing a year-over-year change of +5.3%. Revenue is expected to be $12.39 billion, up 17.9% from the previous quarter.

Dicks $DKS+1.8%

This sporting goods retailer is expected to post quarterly earnings of $2.86 per share in its upcoming report, representing a year-over-year change of -21.4%. Revenue is expected to be $3.41 billion, up 1.7% from the previous quarter.

- Whose results do you care about? 🤔