Recently, I have been intrigued by a company that operates in a very interesting field. That company is Luminar Technologies $LAZR. So let's take a look at this company together, and introduce it a little bit.

Basic information about the company

Luminar Technologies, Inc. is a high-tech company that specializes in the design and development of LiDAR sensors and perception software for autonomous vehicles. Founded in 2012 by Austin Russell, the company has quickly grown into one of the leading players in the autonomous vehicle industry.

Luminar Technologies, Inc. operates on a business-to-business (B2B) model and provides its products and services directly to original equipment manufacturers (OEMs) and vehicle manufacturers in the automotive industry. The Company's revenue is generated from the sale of LiDAR sensors used by OEMs and vehicle manufacturers to develop autonomous driving technology for their vehicles. Luminar's primary focus is on providing high performance LiDAR sensors that can operate in a wide range of environmental conditions and can detect objects up to 250 meters away.

Luminar has partnerships with several automakers, including Volvo, Audi and Toyota. Luminar is also working with Mobileye, a former Intel subsidiary, to develop a complete autonomous driving system. Luminar's lidar sensors are integrated into Mobileye's camera system, which is used in autonomous vehicles.

The company's products and services

The company specializes in the development and manufacture of advanced lidar sensors and software for use in autonomous vehicles. The Company's products and services include:

Iris: This is Luminar's flagship lidar sensor, which features long-range, high-resolution 3D sensing capability. The sensor is designed to help autonomous vehicles "see" their surroundings and make real-time decisions for safe navigation.

Sentinel: This is Luminar's software platform that includes perception, mapping and location software that enables autonomous vehicles to understand their environment and make informed decisions in real time.

Automotive Hardware and Software Integration: Luminar offers integration services to automakers and other customers to help them develop complete autonomous driving systems that include Luminar's sensors and lidar software.

Testing and Verification Services: Luminar also offers testing and verification services to help customers ensure that their autonomous driving systems are safe and reliable.

Competitive advantage

Thecompany sees its main competitive advantage in its patented lidar technology, which the company claims has a longer range and higher resolution than other lidar sensors on the market. Luminar's lidar sensors use a technology called "frequency modulated continuous wave" (FMCW), which emits a continuous wave of light and measures the time it takes for the light to bounce back, rather than using a pulsed laser.

A look at the numbers

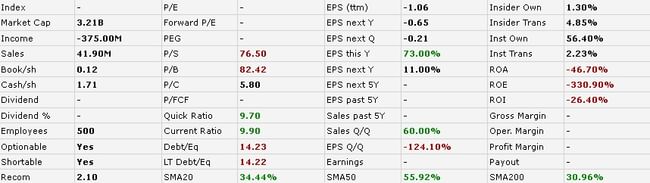

An initial look at the basic ratios is terrible. The company is losing money, and is not even close to achieving proper sales. In short, the company looks pretty lousy by basic ratios. Moreover, looking to the left, the company has a negative return on equity as well as a negative return on invested capital.

I have the company's 2019 results available, so let's take a closer look. Through 2021, the company's revenue has grown at an average rate of about 50% per year. Sales for the last 12 months are at roughly $42 million. That's a year-over-year increase of about 32%.

Unfortunately, at the moment, the company is failing to manufacture its products efficiently, which is a huge problem. In fact, the cost of manufacturing the company's products is much higher than the revenue generated from the sale of these products. In short, the company sells its products for less than it costs to produce them. As a result, the company does not even generate a gross profit, let alone a net profit.

The company's balance sheet looks quite strong, with the company managing to accumulate more cash in its accounts each year, which it will surely need. As for debt, I don't see a big problem there either. The company would be able to pay virtually all of its liabilities with its cash.

Advantages and disadvantages of the company

Of course, like all other companies, this company has its advantages and disadvantages, so let's take a look together.

Advantages:

- Patented lidar technology: Luminar's lidar technology is considered superior to other lidar sensors on the market, giving the company a competitive advantage in the autonomous vehicle industry.

- Strong partnerships: Luminar has partnerships with several major automakers, including Volvo, Audi and Toyota, as well as Mobileye, a former subsidiary of Intel, which could help the company establish a strong position in the industry.

- Growing industry: The autonomous vehicle industry is expected to grow rapidly in the coming years, which could provide Luminar with significant growth opportunities.

Disadvantages:

- High competition: the autonomous vehicle industry is highly competitive, and there are several other companies developing lidar sensors and other autonomous vehicle technologies that could eventually surpass Luminar.

- Operating at a loss: Luminar is operating at a net loss, which could be of concern to investors. It even has higher production costs than sales revenue.

- Industry uncertainty: The autonomous vehicle industry is still in the early stages of development and there is no guarantee that autonomous vehicles will become widely adopted, which could limit Luminar's growth potential.

Conclusion

So, today we have introduced a company that operates in an industry that definitely has a future. In my opinion, autonomous vehicles will be the next step after electric vehicles. But it is a sector that is simply still a big unknown for us. The question will be whether manufacturers will be able to produce these vehicles efficiently and whether these vehicles will be affordable for the general public.

For me personally, at the moment, the company is not suitable for investment. This is mainly due to production efficiency, where the company is not even able to make positive gross margins for the time being. The company still has a lot of work to do, and one of the first steps should be to work on streamlining the production of its products, and overall streamlining the operations of the entire company. It is not very often that a company has both negative gross profits and negative gross profits.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.