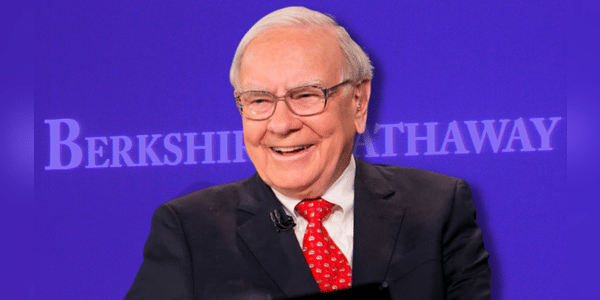

Usually when investors look at Buffett's portfolio and find a stock they like, they think about buying it. But that's not always a good option. Which 2 stocks from Buffet's portfolio should we currently avoid? And why aren't these stocks currently a good choice, even though Warren Buffett himself has them?

Warren Buffett is one of the most famous investors in history and his investment philosophy has been the subject of countless books and articles. But not every stock he chooses is a good value. In fact, there are two companies that Buffett invested in that investors may want to avoid.

Now, the question that probably comes to everyone's mind is why anyone would avoid stocks that Warren Buffett himself invests in. The answer is simple. The problem may be price. As we all know, Buffett prides himself on buying undervalued stocks, which is important to consider in this case. Buffett could be buying the stock in question at a much lower price than the market is currently trading at. This…