Everybody knows that the market is wild now. But the crucial question is whether it is time to buy and, if so, at what price. A leading analyst firm seems to have the answer to both questions.

According to Tom Lee of Fundstrat, the stock market is poised for a strong rally in March and April after the February sell-off reignited bearish sentiment among investors.

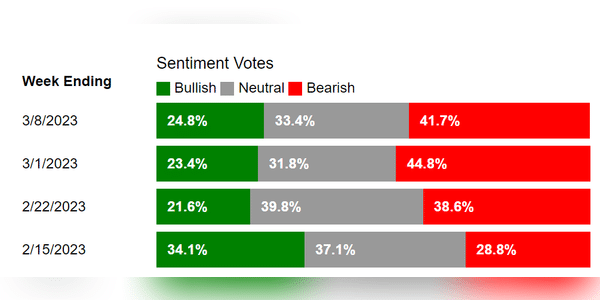

Lee noted that investor sentiment quickly shifts into gloomy and negative territory at any sign of stock market weakness, indicating that investors are still too bearish on stocks .

Consider that from February 8 to 22, the stock market fell less than 3%, yet bearish respondents to the weekly investor sentiment survey rose 54% to a level above the historical average. In other words, investors are on edge and worried that the strong start to January was just a bear market rally.

"Many believe…